In a world where luxury meets corporate consolidation, the announcement made last year (10 August 2023) that Tapestry, Inc. (NYSE: TPR) will be acquiring Capri Holdings Limited (NYSE: CPRI) for $57 per share has stirred the waters of the financial markets, akin to a tempest in a teapot. This deal, valuing Capri at a staggering $8.5 billion, is set to create a new heavyweight in the entry-level luxury goods industry, positioning the combined entity among the likes of LVMH and Kering (both positioned in a completely different market segment). The deal has already been approved with an extraordinary 99.6% of votes in favour on 25 October. The merger is expected to close in the second half of 2024, as soon as the appeal to the FTC (which filed against it in April) is closed and the go-ahead is given.

Tapestry and Capri Holdings: A Brief Overview

For the uninitiated, Tapestry—formerly known as Coach—boasts a portfolio glittering with brands like Coach, Kate Spade, and Stuart Weitzman. On the other hand, Capri Holdings, previously known as Michael Kors Holdings, shines with Michael Kors, Jimmy Choo, and Versace under its belt. This merger is more than just a marriage of high-end brands; it’s a strategic move to navigate the changing tides of the luxury market.

The Announcement and Market Reaction

When Tapestry announced its intention to acquire Capri on August 10th, 2023, initial reactions were mixed. As can be seen from the stock price graph above, at the time the takeover was announced, Capri's share price jumped to $53.9 from $34.6, an increase of 55.78%. While some hailed it as a masterstroke of corporate strategy, others viewed it through the lens of skepticism, fearing regulatory roadblocks and integration challenges. The market’s response was notably cautious in the following months, with the probability of the deal closing dipping to a modest 58.6% today.

This figure, like a barometer, reflects the prevailing uncertainty and the myriad of factors that investors weight.

In the grand theatre of M&A, the Tapestry-Capri deal is a performance worth watching, not just for its potential to reshape the luxury landscape, but also for the drama that inevitably accompanies such high-stakes negotiations.

So why does this merger matters?

Simple—luxury brands are more than just symbols of opulence; they are cultural icons, trendsetters, and economic powerhouses. A merger of this magnitude has the potential to alter market dynamics, influence fashion trends, and shift consumer preferences.

Moreover, from an investor perspective, such deals often present unique opportunities for arbitrage and value plays. The spread between Capri’s current trading price and the acquisition price of $57 per share offers an incredible prospect for savvy investors. However, as with any investment, this comes with its share of risks—regulatory hurdles, financing issues, and potential market volatility, to name a few…

A Look Ahead

As we delve deeper into the intricacies of this deal, we will explore the historical contexts of both companies, the specifics of the merger agreement, the regulatory landscape, and the strategic outcomes. Our journey will be both quantitative and qualitative, mixing hard numbers with insightful analysis and, of course, a touch of irony.

Background and History

Tapestry: A Journey Through Time

Once upon a time in the bustling streets of New York, a small leather goods workshop named Coach was born in 1941. Over the decades, Coach evolved from a niche artisan shop to a global luxury brand, renowned for its high-quality craftsmanship and iconic designs. The turn of the millennium saw Coach expanding its horizons, both geographically and through acquisitions. In 2017, in a bid to unify its burgeoning portfolio under a single identity, Coach Inc. rebranded itself as Tapestry, Inc. – a name symbolizing the rich, woven fabric of its diverse brand collection.

Tapestry's current lineup includes:

Coach: The flagship brand, known for its modern American style and premium leather goods.

Kate Spade: Acquired in 2017, this brand brings a whimsical, spirited approach to fashion and accessories.

Stuart Weitzman: Famous for its high-end footwear, this brand joined the Tapestry family in 2015.

This triad of brands has helped Tapestry position itself as a formidable player in the accessible luxury market, a niche that balances affordability with a touch of high-end allure.

Capri Holdings: From Michael Kors to a Global Fashion Empire

On the other side of the Atlantic, Michael Kors founded his eponymous brand in 1981. The brand quickly became synonymous with luxurious jet-set fashion, blending chic sophistication with a hint of flamboyance. Like Tapestry, Michael Kors Holdings embarked on an ambitious acquisition spree, culminating in a rebrand to Capri Holdings Limited in 2018.

Capri Holdings' treasure chest includes:

Michael Kors: The quintessential American luxury brand known for its ready-to-wear collections, handbags, and accessories.

Jimmy Choo: Acquired in 2017, this brand adds a dash of glamour with its high-fashion footwear and accessories.

Versace: The crown jewel of Capri's acquisitions, Versace, was purchased in 2018, bringing a legacy of opulence, bold designs, and a storied heritage to the portfolio.

Capri Holdings has leveraged these brands to create a powerful trifecta in the luxury market, mirroring Tapestry’s strategy of brand diversification and market expansion.

Previous Acquisitions and Growth Strategies

Both Tapestry and Capri Holdings have a storied history of strategic acquisitions, aimed at bolstering their market positions and expanding their brand portfolios. Tapestry’s acquisition of Kate Spade and Stuart Weitzman and Capri’s acquisitions of Jimmy Choo and Versace are testament to their growth-oriented strategies.

These acquisitions were not mere shopping sprees but calculated moves to capture new market segments, enhance product offerings, and leverage synergies across brands. For instance, Kate Spade’s playful and youthful brand identity complements Coach’s classic sophistication, while Stuart Weitzman’s footwear expertise enriches Tapestry’s accessory lineup.

Similarly, Capri Holdings’ acquisition of Jimmy Choo expanded its footprint in the luxury footwear market, while Versace’s inclusion added a layer of high-fashion allure, diversifying its appeal beyond the accessible luxury segment that Michael Kors dominates. Such strategic moves illustrate the companies' adeptness at navigating the luxury market’s complexities, akin to skilled chess players plotting their next move.

The Path to Merger

Given their parallel strategies and complementary brand portfolios, the merger between Tapestry and Capri Holdings seems like a natural progression in their evolutionary paths. This union is not just about consolidating brands but about creating a powerhouse capable of competing with European giants like LVMH and Kering.

As the luxury market evolves, driven by changing consumer preferences and digital transformation, this merger aims to leverage combined strengths to capture new growth opportunities and navigate market challenges.

Details of the Merger Agreement

Terms of the Merger Agreement

The Tapestry-Capri Holdings merger, announced on August 10, 2023, is structured as an all-cash transaction valued at $57 per share, amounting to a total of approximately $8.5 billion.

The acquisition is not subject to a financing condition. Tapestry has secured $8 billion in fully committed bridge financing from Bank of America N.A. and Morgan Stanley Senior Funding, Inc. The funding for the purchase price will come from a combination of senior notes, term loans, and excess Tapestry cash. A portion of this will be used to pay off certain existing outstanding debts of Capri Holdings.

Strategic Rationale and Synergies

The merger is expected to generate approximately $200 million in annual synergies within three years of closing. Additionally, the combined company is projected to generate over $12 billion in annual sales and nearly $2 billion in adjusted operating profit.

Strategic Benefits:

Enhanced Scale and Market Presence: The combined entity will become one of the largest global players in the luxury goods market, with a diverse portfolio of iconic brands.

Geographic Expansion: The merger will enhance the companies' international presence, particularly in Asia and Europe, leveraging Capri's existing footprint and Tapestry's strategic initiatives.

Complementary Brand Portfolios: The merger brings together complementary brands that cater to a broad spectrum of consumer preferences, from accessible luxury to high fashion.

Operational Synergies:

Supply Chain and Procurement: Consolidating the supply chains of Tapestry and Capri will enable better negotiation power with suppliers and more efficient inventory management.

Marketing and Distribution: Combined marketing efforts and a unified distribution network will enhance brand visibility and reach, reducing overall marketing expenses.

Digital Transformation: Leveraging Tapestry's advanced digital capabilities and Capri's established e-commerce platforms to drive growth in online sales channels.

Regulatory and Antitrust Considerations

Overview of Regulatory Approvals

The journey of the Tapestry-Capri Holdings merger through the regulatory maze has seen significant milestones. As of now, the deal has received the green light from both the European Union and Japan. These approvals were crucial steps forward, given that regulatory scrutiny can often be the Achilles' heel in high-stakes mergers.

The European Commission, under the EU Merger Regulation, and Japan's Fair Trade Commission have both given their unconditional approval to the merger. This signifies that, in their view, the merger does not pose substantial anti-competitive concerns in their respective markets.

Before writing this article, I consulted several sources as well as read articles and watched interviews from Cedar Grove Capital Management, Valorem Legal Research and Yet Another Value Blog, which I highly recommend you visit and subscribe!

In these articles and interviews, the argument against the FTC blocking the deal is very clearly stated. That is why I will take the liberty of partly restating these theses and adding my own point of view.

Current Challenge: The U.S. Federal Trade Commission (FTC)

While the approvals from the EU and Japan have been secured, the merger now faces its most significant hurdle: the U.S. Federal Trade Commission (FTC). The FTC has requested additional information from Tapestry and Capri Holdings as part of its in-depth review process. This step, to be held on 25 September, known as a "second request," typically indicates that the FTC has concerns about the potential anti-competitive effects of the merger and requires more detailed data to make a determination.

The FTC's scrutiny is particularly focused on the potential reduction of competition in the luxury goods market, which could lead to higher prices, reduced innovation, and fewer choices for consumers. Given the high-profile nature of both companies involved, the merger's impact on market dynamics is under the microscope.

Historical Precedents and Market Context

In the luxury goods sector, mergers and acquisitions are not uncommon. Industry giants like LVMH and Kering have built their empires through strategic acquisitions, creating portfolios that encompass a wide range of high-end brands. For instance, LVMH's acquisition of Tiffany & Co. and Kering's numerous brand consolidations have set precedents in the market. These historical examples provide a context where large-scale mergers have successfully navigated regulatory landscapes, albeit with some concessions and adjustments.

Key Regulatory Concerns

Market Share and Competition: The combined entity of Tapestry and Capri Holdings will control a significant portion of the accessible luxury market. The FTC's primary concern is whether this merger will lead to a duopoly in certain segments, particularly in the U.S. handbag market, where Coach and Michael Kors are prominent players.

Consumer Impact: The FTC is evaluating how the merger might affect consumers in terms of pricing, product variety, and innovation.

Employee Welfare: Another point of contention is the potential impact on employees. The FTC is considering whether the merger might lead to reduced bargaining power for employees, affecting wages and benefits. This concern stems from historical patterns observed in large corporate mergers where workforce consolidations often lead to job cuts and changes in employee conditions.

Historical Precedents and FTC Behavior

LVMH-Tiffany & Co.: Despite initial resistance and a lawsuit attempting to delay the acquisition, LVMH successfully acquired Tiffany & Co. in 2021. The FTC did not block this merger, indicating a precedent where large luxury mergers have navigated regulatory hurdles successfully.

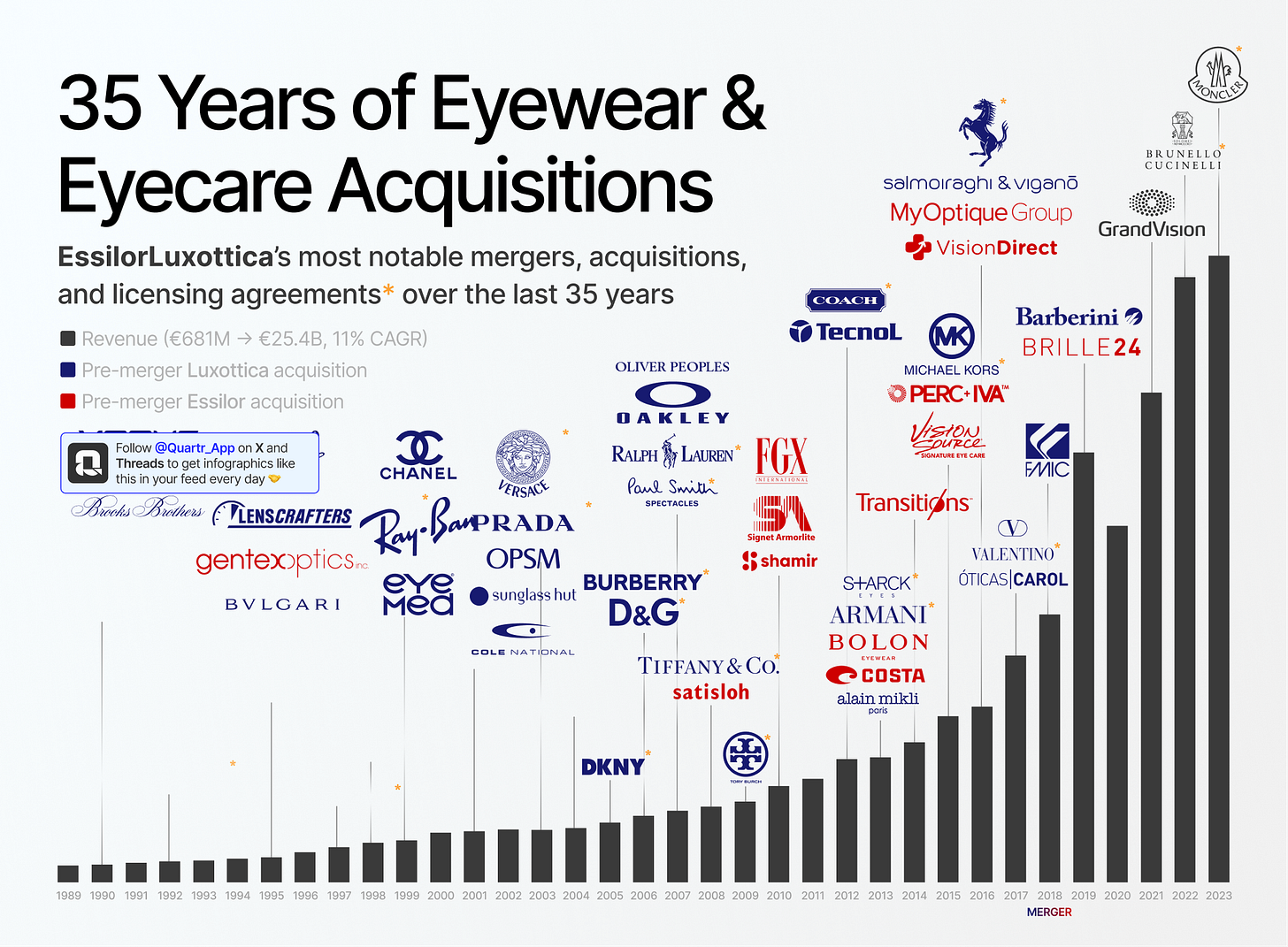

EssilorLuxottica-GrandVision: This merger faced significant scrutiny in multiple jurisdictions, including the FTC. Despite concerns over market concentration in the eyewear sector, the deal was approved with minor concessions.

FTC’s Focus Areas:

The FTC primarily scrutinizes mergers for anti-competitive effects, particularly where market concentration could lead to monopolistic behaviors. However, the luxury goods market is characterized by high brand differentiation and significant consumer choice, reducing the risk of monopoly.

Previous FTC concerns have focused on sectors with direct consumer impact on pricing and availability, such as technology and healthcare, where the dynamics differ significantly from the luxury goods market.

The FTC’s historical approach to luxury goods mergers suggests that while thorough, they are not insurmountable. The distinct nature of the luxury market, with its emphasis on brand identity and differentiation, often mitigates monopoly concerns.

Market Dynamics and Competition

Fragmentation and Consumer Choice:

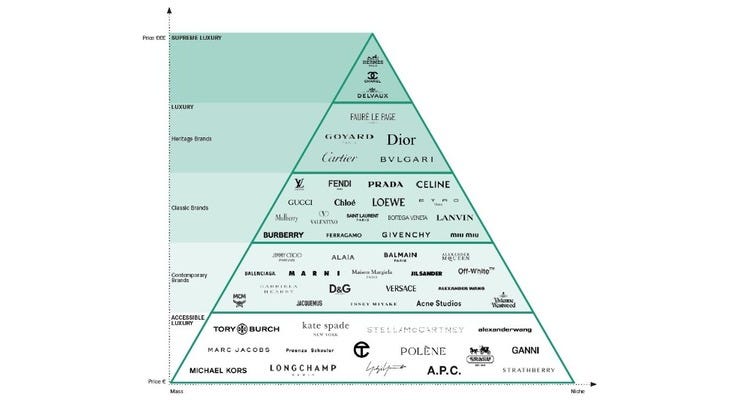

The luxury goods market is highly fragmented, with numerous players ranging from high-end brands like Chanel and Gucci to more accessible luxury brands like Tory Burch and Michael Kors.

The combined market share of Tapestry and Capri Holdings, post-merger, is expected to be around 5.1% of the global luxury market, which is significantly lower than industry giants like LVMH, which commands a market share exceeding 15%.

Geographic Diversification:

Both Tapestry and Capri Holdings have substantial international operations, reducing their dependence on any single market. This geographic diversification inherently limits their market power within any single regulatory jurisdiction, including the U.S.

The fragmented nature of the luxury market and the significant presence of other major players reduce the likelihood that the merger will substantially lessen competition. Geographic diversification further mitigates potential anti-competitive concerns within the U.S. market specifically.

Quis custodiet ipsos custodes? – Who will guard the guards themselves?

The FTC’s scrutiny, while rigorous, is not arbitrary. Historical precedents and market dynamics suggest that with strategic concessions, the Tapestry-Capri merger stands a strong chance of approval.

Market Arbitrage Analysis

Current Market Conditions and Price Analysis

As of today, Capri Holdings (NYSE: CPRI) is trading at approximately $33.4 per share, while the agreed acquisition price is $57 per share. This discrepancy creates a spread of $23.6 per share, representing a potential return of 70.6% if the merger closes successfully.

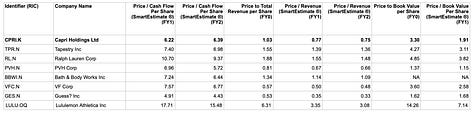

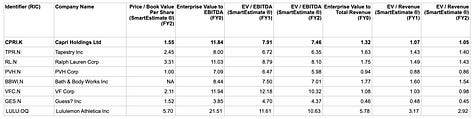

Taking a quick look at the financial data, we can see that trading multiples are in consistent if not inexpensive compared to comparables such as Ralph Lauren, Guess, Lululemon, VFC and other “affordable luxury” brands.

By choice I have decided not to proceed as usual with an in-depth evaluation of Capri, since since the offer is more than higher than the analysts' target value, so instead of DCF and trading multiples I will simply say that the current financials are in line with the market and that the offer submitted by Tapestry definitely fits the arbitrage strategy. Especially taking into consideration that the stock is currently trading practically at last year's pre-acquisition announcement value.

Actionable Steps for Arbitrage

Establishing a Position:

Buy CPRI Shares: The target is to benefit from the eventual closing of the merger at $57 per share.

Assess Risk Tolerance: Ensure that your position size aligns with your risk tolerance, considering the regulatory risks involved.

Hedging Strategies:

Options Strategies: Use options to hedge against potential downside risks. For instance, buying put options on CPRI can protect against a significant drop in share price if the merger falls through.

Pairs Trading: Another approach is to short a comparable luxury goods stock to hedge against sector-wide risks. For example, shorting shares of a competitor like Ralph Lauren (NYSE: RL) or PVH Corp (NYSE: PVH) can offset some market volatility specific to the luxury segment.

Trading Timeline:

Short-Term Movements: Be prepared for short-term volatility, especially around key regulatory decision dates. This could provide additional trading opportunities if the spread widens temporarily.

Long-Term Outlook: Given the merger’s expected closure in 2024, patience is vital. The eventual payoff, assuming successful closure, justifies the wait.

Scenario Analysis

Best-Case Scenario:

Outcome: FTC approves the merger without significant concessions.

Impact: $CPRI shares rise to the acquisition price of $57, yielding a 70.6% return from the current price.

Moderate-Case Scenario:

Outcome: FTC approves the merger with some concessions, possibly delaying the closure.

Impact: $CPRI shares gradually approach $57 but might face temporary dips.

Worst-Case Scenario:

Outcome: FTC blocks the merger, leading to a sharp drop in CPRI shares.

Impact: $CPRI shares could fall to pre-announcement levels or lower, around $20-$25. Utilize hedging strategies like puts to mitigate losses. If unhedged, evaluate the long-term fundamentals of Capri Holdings and decide whether to hold through the volatility.

Why This is a Bargain Today

Despite the regulatory uncertainty, the fundamentals of both Tapestry and Capri Holdings, combined with the strategic synergies expected, present a strong case for the merger. The 70.6% spread at today’s prices, with supportive international approvals, suggests the market is overly pessimistic about the FTC’s decision. This pessimism provides an attractive entry point for arbitrageurs.

Secondary Investment Thesis: Capri Holdings as a Long-Term Investment

Even if the Tapestry-Capri Holdings merger does not go through, investing in Capri Holdings (CPRI) at current prices could still be a smart long-term investment. I leave the assessments of Capri's intrinsic value to you (otherwise this article could go on forever)!

Here’s my qualitative take:

Strong Brand Portfolio:

Capri Holdings owns iconic brands such as Michael Kors, Jimmy Choo, and Versace. Each of these brands has a strong market presence and loyal customer base, providing a solid foundation for future growth.

The diversification across different segments of the luxury market (ready-to-wear, accessories, footwear) mitigates risk and enhances revenue stability.

Growth Opportunities in Emerging Markets:

Capri Holdings has been expanding its footprint in high-growth markets such as Asia, particularly China. The rising middle class and increasing disposable income in these regions present significant growth opportunities.

The company’s strategic focus on expanding its digital and e-commerce capabilities aligns well with the growing trend of online luxury shopping.

Operational Efficiency and Profitability:

Despite the challenges posed by the pandemic, Capri Holdings has demonstrated resilience and operational efficiency. The company has implemented cost-saving measures and streamlined operations to maintain profitability. With a focus on improving margins and reducing debt, Capri is well-positioned to enhance its financial health in the long run.

Innovation and Product Development:

Capri Holdings continues to invest in innovation and product development, keeping its brands relevant and appealing to consumers. Collaborations, limited-edition releases, and new product lines drive consumer interest and sales. The company’s emphasis on sustainability and ethical fashion practices resonates with the growing consumer demand for responsible luxury.

Attractive Valuation:

At current prices, Capri Holdings offers an attractive valuation, especially considering its strong brand equity and growth potential. Investors can potentially benefit from capital appreciation as the market recognizes the intrinsic value of the company.

Conclusion

Even without the merger, Capri Holdings stands as a robust investment opportunity. Its strong brand portfolio, strategic growth initiatives, operational efficiency, and focus on innovation make it a compelling choice for long-term investors. The current market conditions provide a favorable entry point, presenting a potential upside as Capri continues to execute its growth strategy.

If you made it to the end I can only thank you! I hope you have found this article useful and enjoyed it, I will try to be as consistent as possible with the publication and when there are updates I will write another article.

If you would like to support me in this work I would be very glad to receive a like and if you would like to share the post you would give me an incredible contribution to make Strategic Alpha known to as many people as possible!

See you soon

Attilio

*Disclaimer

The information provided on Strategic Alpha - a Special Situations Gazette is for informational purposes only and should not be construed as financial advice. While I may hold positions in some of the stocks discussed, I do not take responsibility for any decisions made based on the content of this site. It is crucial for readers to conduct their own due diligence and consult with a professional financial advisor before making any investment decisions.

All logos and trademarks displayed in conjunction with this article are the registered trademarks or copyrighted properties of their respective owners, including but not limited to Tapestry Inc. and Capri Holdings Limited. The use of these logos and trademarks is intended solely for informational and illustrative purposes, and does not imply any endorsement, sponsorship, or affiliation with the respective companies. All rights to the logos and trademarks are retained by the respective trademark and copyright owners.