Crest Nicholson Holdings (CRST.L)

Bellway's (BWY.L) Acquisition of Crest Nicholson (CRST.L): A Game-Changer or Just Another Bid?

The UK housing market is buzzing with yesterday’s news of Bellway's (BWY.L) second bid to acquire Crest Nicholson (CRST.L).

Welcome to Strategic Alpha, today we dive into this high-stakes game that could redefine the UK property market. Whether you're an investor or just curious about the latest market moves, I'll break down the synergies, market reactions and potential rival bids. Join me as we explore whether this deal will create a housing titan or trigger a fierce bidding war.

Let's dive in!

Table of Contents

Introduction

Chronology of Offers and Responses

Valuation Analysis of Crest Nicholson

Evaluation of Bellway’s Offer

News and Market Reactions

Arbitrage Opportunities and Risks

Possible Scenarios and Strategic Outcomes

My Final Take

1. Introduction

Background of Bellway p.l.c.

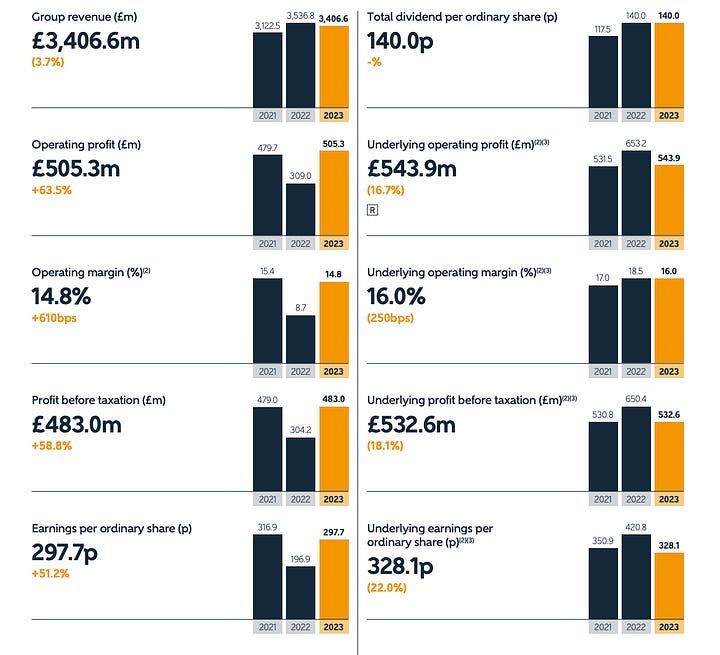

Bellway p.l.c. is one of the UK's largest housebuilders, known for constructing high-quality homes across the country. With a market capitalization of approximately £3.2 billion as of mid-2024, Bellway has a strong presence in both urban and rural areas, offering a diverse range of housing products. The company reported revenues of £3.4 billion in the fiscal year 2023, showcasing its substantial scale and financial robustness.

Bellway’s strategy focuses on geographic expansion and increasing its land bank to support future growth. In recent years, the company has successfully navigated market fluctuations by maintaining a flexible operating model and a conservative approach to financial management.

Background of Crest Nicholson Holdings plc

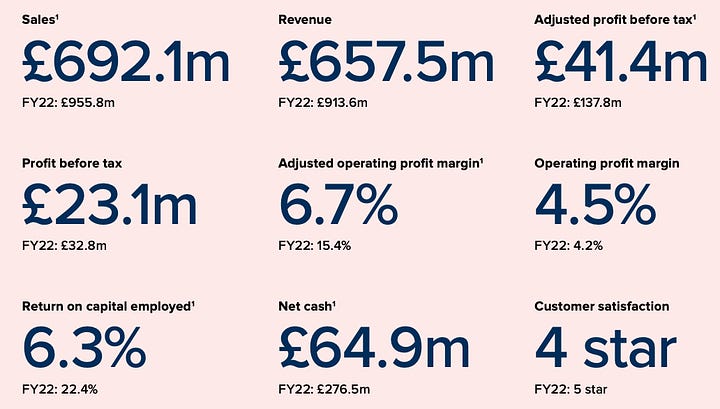

Crest Nicholson Holdings plc, another prominent name in the UK housebuilding sector, focuses on creating sustainable communities. The company’s revenue for FY2023 was £657.5 million, a significant decrease from £913.6 million in FY2022, reflecting challenging market conditions. Crest Nicholson’s strategy emphasizes placemaking, with a strong commitment to sustainability and quality.

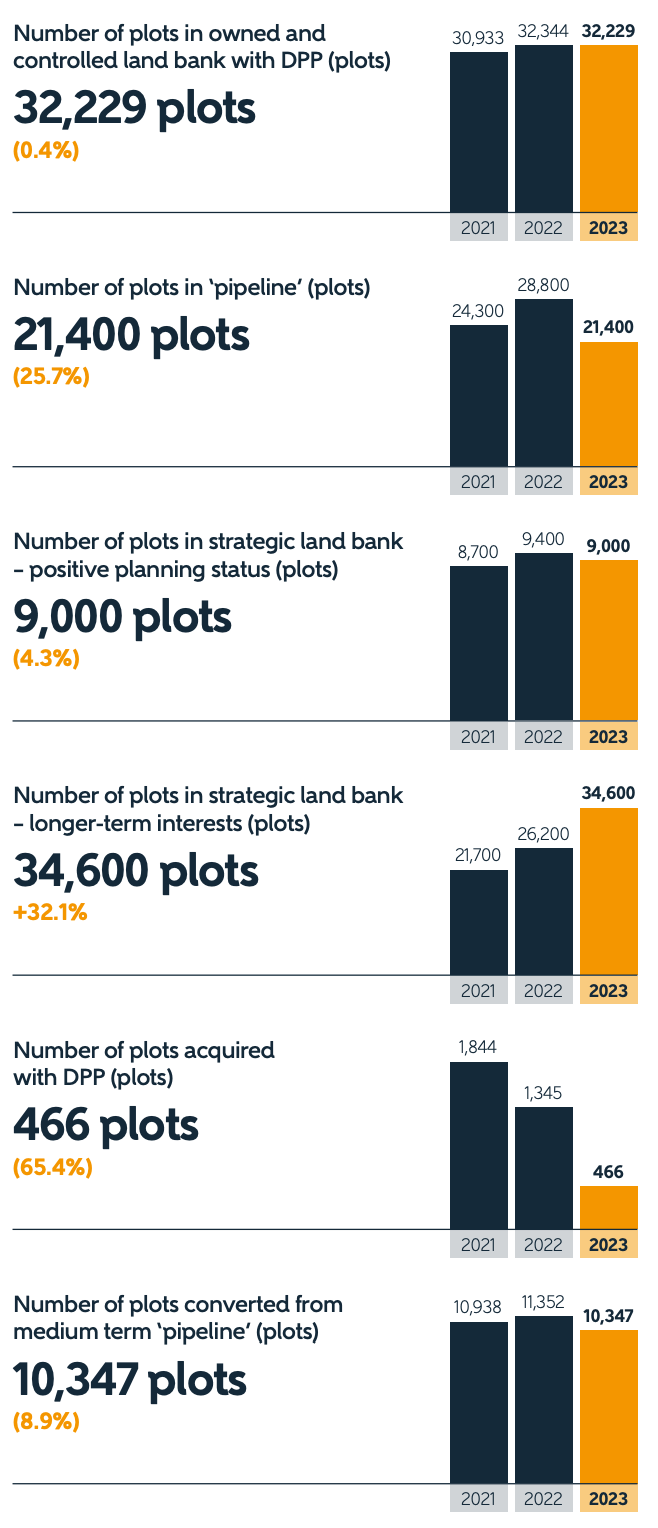

Despite these challenges, Crest Nicholson boasts a robust land portfolio, primarily located in Southern England, where demand for housing remains high. This strategic land bank positions the company well for future growth, making it an attractive acquisition target for larger players like Bellway, especially considering Crest’s deep value and recent market conservative valuation.

Overview of the Proposed Takeover

The story began on June 13, 2024, when Bellway made its first non-binding all-share offer for Crest Nicholson, valuing each Crest Nicholson share at 253 pence. However, Crest Nicholson’s Board deemed the offer insufficient. Bellway persisted, and on July 3, 2024, it submitted a revised proposal, increasing the offer to 273 pence per share, which included an additional dividend component. This offer reflected a 28.3% premium to Crest Nicholson's closing share price on June 13, 2024. The revised terms finally found favor with Crest Nicholson’s Board, marking a turning point in the negotiations.

Why This Takeover Matters

As we proceed, think about the strategic motivations behind Bellway’s persistence.

How does Crest Nicholson’s land portfolio enhance Bellway’s growth prospects? What does this mean for the shareholders of both companies?

By the end of this deep dive, you’ll have a comprehensive understanding of the takeover, equipped with quantitative and qualitative insights to form your investment perspective.

Stay tuned as we unveil the details in the next chapter, where we chronicle the sequence of offers and responses leading up to the latest developments in this high-stakes acquisition.

2. Chronology of Offers and Responses

First Announcement by Bellway (June 13, 2024)

On June 13, 2024, Bellway p.l.c. publicly responded to press speculation regarding Crest Nicholson Holdings plc. Bellway confirmed that on May 7, 2024, it made a non-binding all-share offer to the Board of Crest Nicholson. The terms of this Possible Offer were that Crest Nicholson shareholders would receive 0.093 shares in Bellway for each share they owned in Crest Nicholson. Based on Bellway's share price of 2,718 pence at the close of business on June 13, 2024, this implied a value of 253 pence per Crest Nicholson share. This represented a 30.0% premium to Crest Nicholson’s share price at the time the offer was made and a 20.5% premium to the 3-month volume-weighted average price (VWAP).

Crest Nicholson’s Response to First Announcement (June 14, 2024)

On June 14, 2024, Crest Nicholson Holdings plc responded to Bellway’s announcement. Crest Nicholson confirmed that it had received the revised unsolicited proposal from Bellway on May 7, 2024. However, Crest Nicholson’s Board evaluated the proposal with its financial advisers and unanimously rejected it on May 14, 2024, on the grounds that it significantly undervalued Crest Nicholson and its future prospects. The Board highlighted Crest Nicholson’s strong standalone prospects, supported by its attractive land portfolio and new leadership under Martyn Clark.

Second Revised Proposal by Bellway (July 3, 2024)

Following further discussions, Bellway submitted a second revised proposal to Crest Nicholson on July 3, 2024. This latest non-binding all-share offer proposed that Crest Nicholson shareholders receive 0.099 shares in Bellway for each Crest Nicholson share they owned. Additionally, it included a dividend of 4 pence per Crest Nicholson share, comprising a previously announced interim dividend of 1 pence per share and a special dividend of 3 pence per share conditional on the completion of the transaction. This Revised Proposal implied a value of 273 pence per Crest Nicholson share, representing a premium of 28.3% to the closing price per Crest Nicholson share on June 13, 2024, and a 30.2% premium to the 3-month VWAP per Crest Nicholson share.

Bellway believed this combination would deliver significant operational benefits, including procurement synergies and the ability to open dual outlets on at least 10 current and future Crest Nicholson sites. Bellway also intended to retain and deploy the Crest Nicholson brand across the enlarged group.

Crest Nicholson’s Response to Second Revised Proposal (July 10, 2024)

Yesterday, July 10 2024, Bellway published on their website the second revised proposal. The Board of Crest Nicholson indicated that “the Revised Proposal was at a value they would be minded to recommend unanimously to their shareholders”.

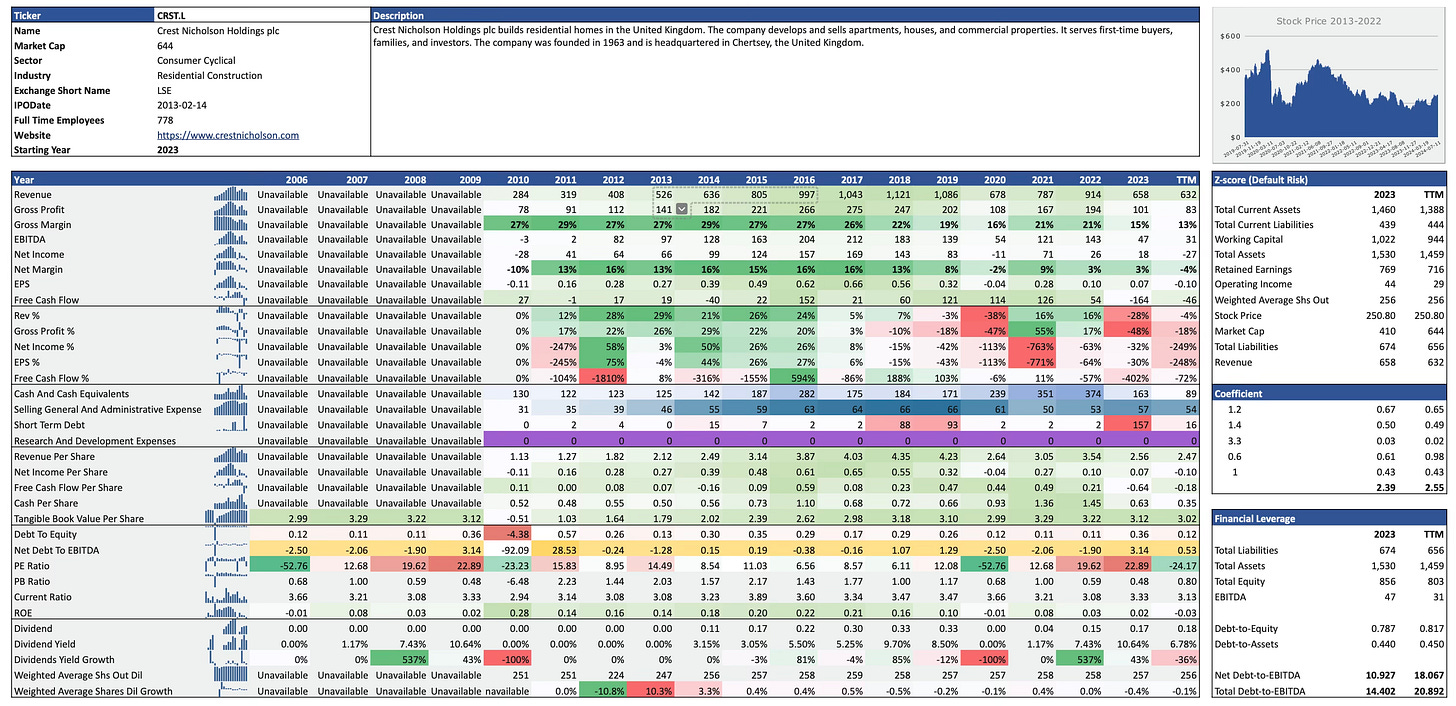

3. Valuation Analysis of Crest Nicholson

In this chapter, we delve into the financials of Crest Nicholson to evaluate its intrinsic value and assess the attractiveness of Bellway's takeover offer.

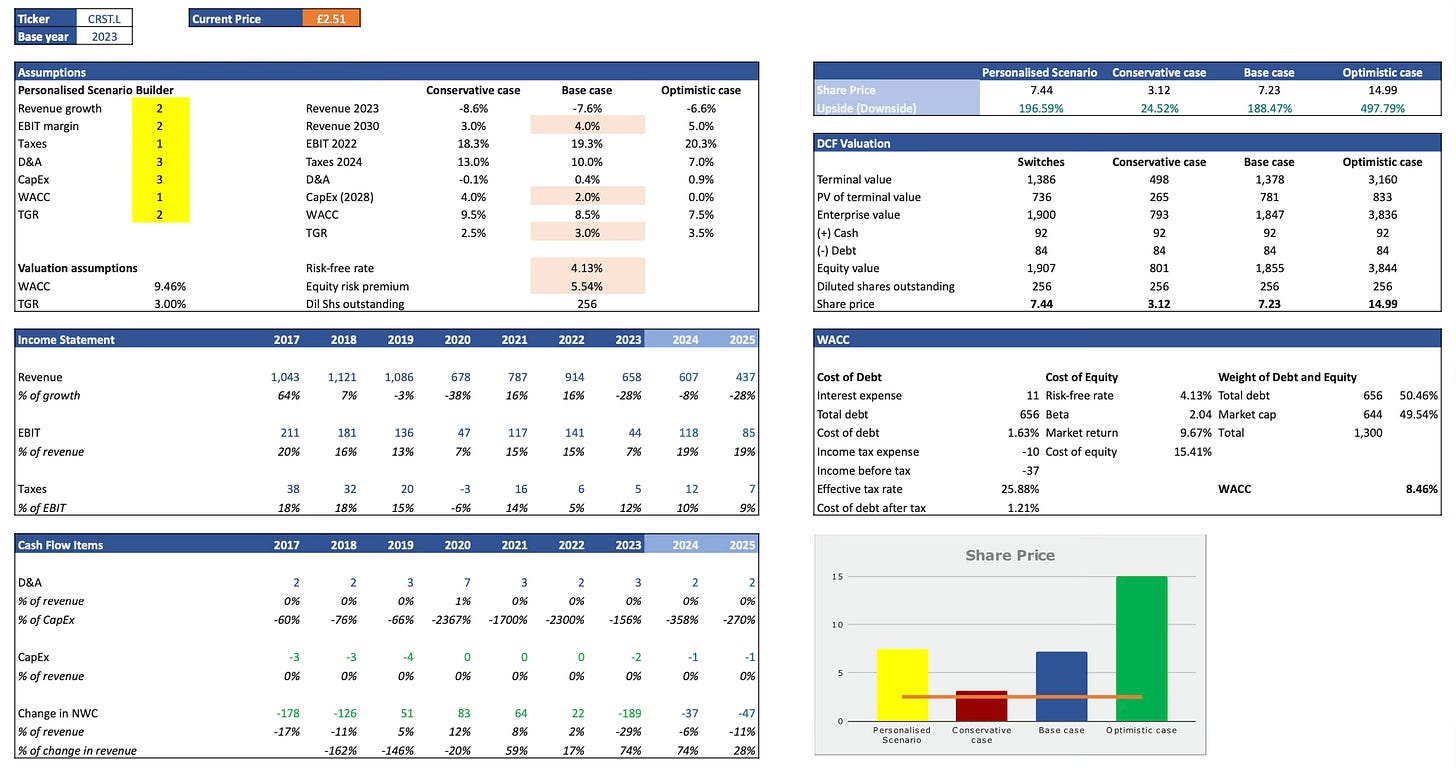

Due to the urgency of publishing this article, the evaluation currently centers on the DCF model, with plans to include additional valuation methods like trading multiples and transaction multiples as well as sensitivity analysis in a future update.

Let’s walk through the key components and findings of this valuation.

Introduction to the Valuation Model

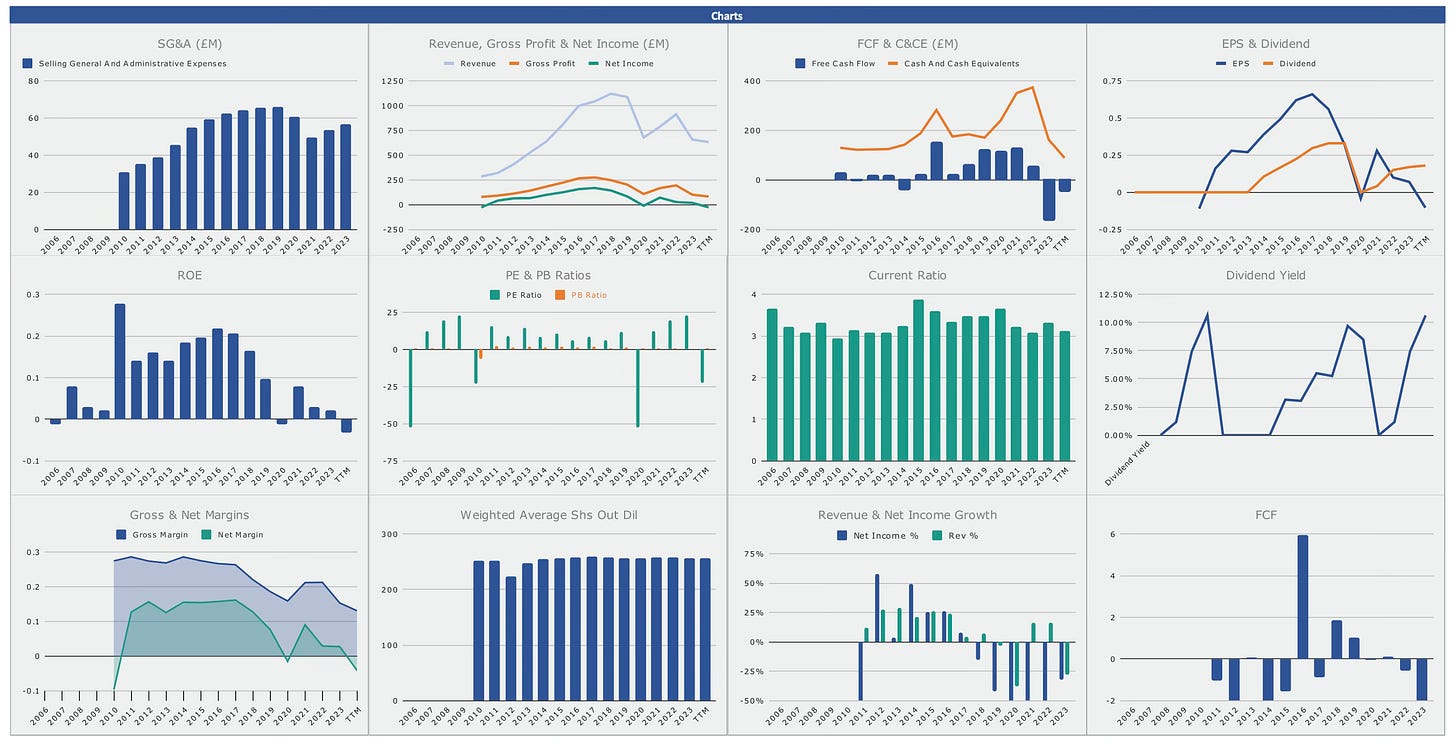

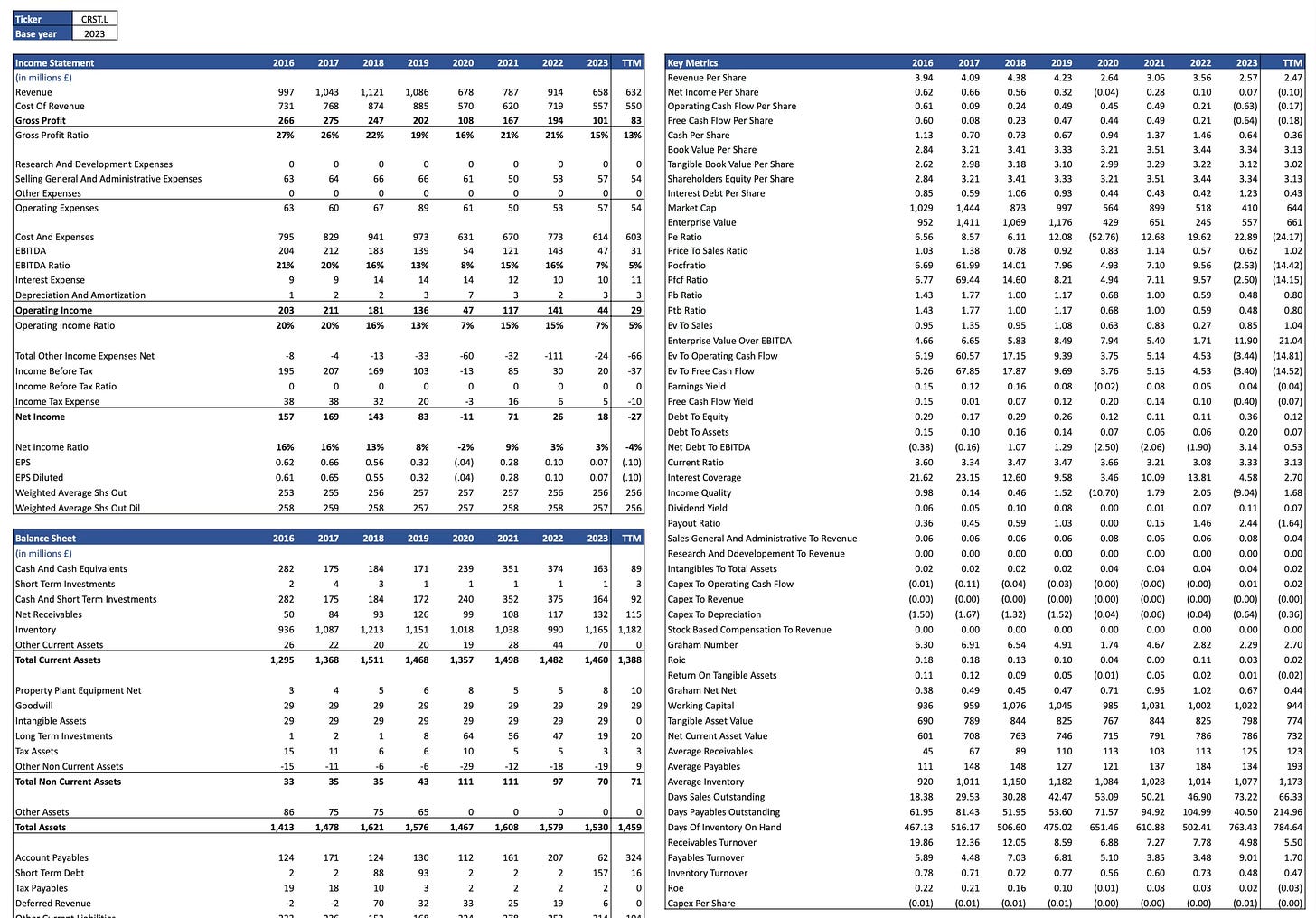

The valuation model aims to capture the fundamental worth of Crest Nicholson by examining various aspects of its financial health and operational performance. The model includes:

Historical Financial Performance: Analysis of revenue, profit margins, and key financial ratios over the past years.

KPI’s Graphs: including PE, PB and Current ratios, FCF, EPS, Revenue and Net income Growth, etc…

Financial Statements, Estimates and Key Metrics: Detailed assessment of the company Balance Sheet, Income Statement and Cash Flow, including some analyst’s estimates.

Discounted Cash Flow (DCF) Analysis: Calculation of the present value of expected future cash flows using a personalised scenario builder.

Key Findings from the Valuation Model

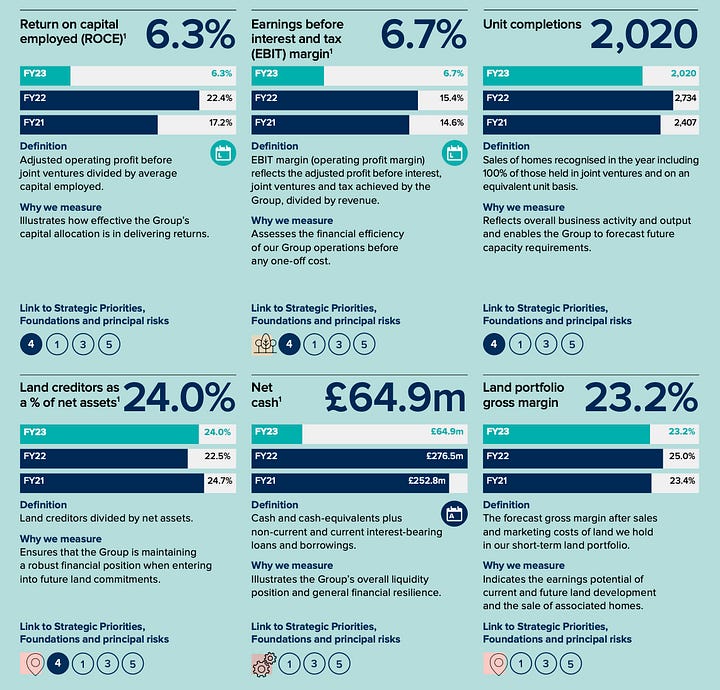

Crest Nicholson’s revenue in FY2023 was £657.5 million, down from £913.6 million in FY2022. This decline is is the result of challenging market conditions, including tighter planning regulations and economic uncertainty. Despite this, the company maintained a strong balance sheet with net cash of £64.9 million, even if down from £276.5 million the previous year.

The adjusted operating profit margin for FY2023 was 6.7%, a significant drop from 15.4% in FY2022. This decrease was primarily caused by lower revenue and higher costs associated with completed site reviews and remediation work. The net profit for FY2023 stood at £23.1 million, down from £32.8 million in FY2022.

Crest Nicholson’s land bank is one of its most valuable assets. The company has a strong portfolio of high-quality sites, predominantly in Southern England, where demand for housing remains robust. The total number of plots, including those with planning consent and those in the development pipeline, provides a solid foundation for future growth.

Looking forward, the model projects a gradual recovery in revenue, driven by strategic land acquisitions and an improvement in market conditions. The company’s focus on placemaking and sustainability is expected to enhance its brand value and customer appeal. Key assumptions in the projections include stable housing prices, moderate growth in sales volumes, and effective cost control measures.

Discounted Cash Flow (DCF) Analysis

The DCF analysis is a critical component of the valuation, providing an estimate of the present value of future cash flows. The model uses a discount rate that reflects the weighted average cost of capital (WACC) for the company, adjusted for market and company-specific risks. Based on this analysis, the intrinsic value of Crest Nicholson is estimated (with my assumptions) to be around £7.44 per share.

Summary of Key Insights

Undervalued Assets: Crest Nicholson’s strong land bank and development pipeline are undervalued in the current market scenario.

Profitability Challenges: The company faces short-term profitability challenges due to higher costs and lower revenue. However, strategic initiatives, market recovery, declining interest rates and cost management efforts are expected to restore margins in the medium term.

The valuation analysis highlights Crest Nicholson’s intrinsic strengths and the strategic rationale behind Bellway’s interest. While there are challenges, the company’s assets and future growth potential offer substantial value.

In the next chapter, we will delve deeper into the specifics of Bellway’s offer, comparing it against our valuation to assess its attractiveness and implications for shareholders.

4. Evaluation of Bellway’s Offer

Having established the intrinsic value of Crest Nicholson through a detailed valuation analysis, it is now essential to evaluate Bellway’s offer in light of these findings. In this chapter, we will dissect the terms of Bellway’s proposal, compare it against our valuation, and examine the strategic and financial implications of the merger.

Terms of Bellway’s Offer

Bellway’s proposal to acquire Crest Nicholson has undergone several revisions, reflecting both persistence and strategic flexibility. The key terms of the latest offer, as announced on July 3, 2024, are as follows:

Share Exchange Ratio: Crest Nicholson shareholders will receive 0.099 Bellway shares for each Crest Nicholson share they own.

Dividend Component: A dividend of 4 pence per Crest Nicholson share, including a 1 pence interim dividend and a 3 pence special dividend conditional on the completion of the transaction.

Implied Value: Based on Bellway’s share price of 2,718 pence on June 13, 2024, the implied value of the offer is 273 pence per Crest Nicholson share.

Premium Offered: The offer represents a 28.3% premium to the closing price per Crest Nicholson share on June 13, 2024, and a 30.2% premium to the 3-month volume-weighted average price (VWAP).

Comparative Analysis with Valuation

Our valuation model estimated Crest Nicholson’s intrinsic value to be around 744 pence. Bellway’s offer, at 273 pence per share, is below this valuation, highlighting a potential undervaluation from a standalone perspective. However, it’s crucial to consider the strategic benefits and synergies that could arise from the merger.

Strategic and Financial Rationale

Let’s delve into the various types of synergies and how they might play out in this specific merger.

Cost Synergies

Economies of Scale: One of the primary benefits of the merger is the ability to achieve economies of scale. By combining operations, Bellway and Crest Nicholson can reduce per-unit costs due to increased production volumes. This can lead to lower costs for materials, labor, and overhead.

Procurement Synergies: With a larger operational scale, the combined entity can negotiate better terms with suppliers, resulting in cost savings on raw materials and services. Bulk purchasing power often translates into significant discounts and better payment terms.

Revenue Synergies

Cross-Selling Opportunities: The merger can open up opportunities for cross-selling complementary products and services. Bellway’s extensive network and brand strength can help promote Crest Nicholson’s developments and vice versa.

Enhanced Product Offering: By integrating the product portfolios, the combined company can offer a more comprehensive range of housing solutions, catering to a broader customer base.

As we move forward, the focus will be on how well these strategic goals are executed and whether the combined entity can achieve the projected efficiencies and growth. In the next chapter, we will analyze market reactions, news coverage, and shareholder sentiment to gain further insights into the potential outcomes of this high-stakes merger.

5. News and Market Reactions

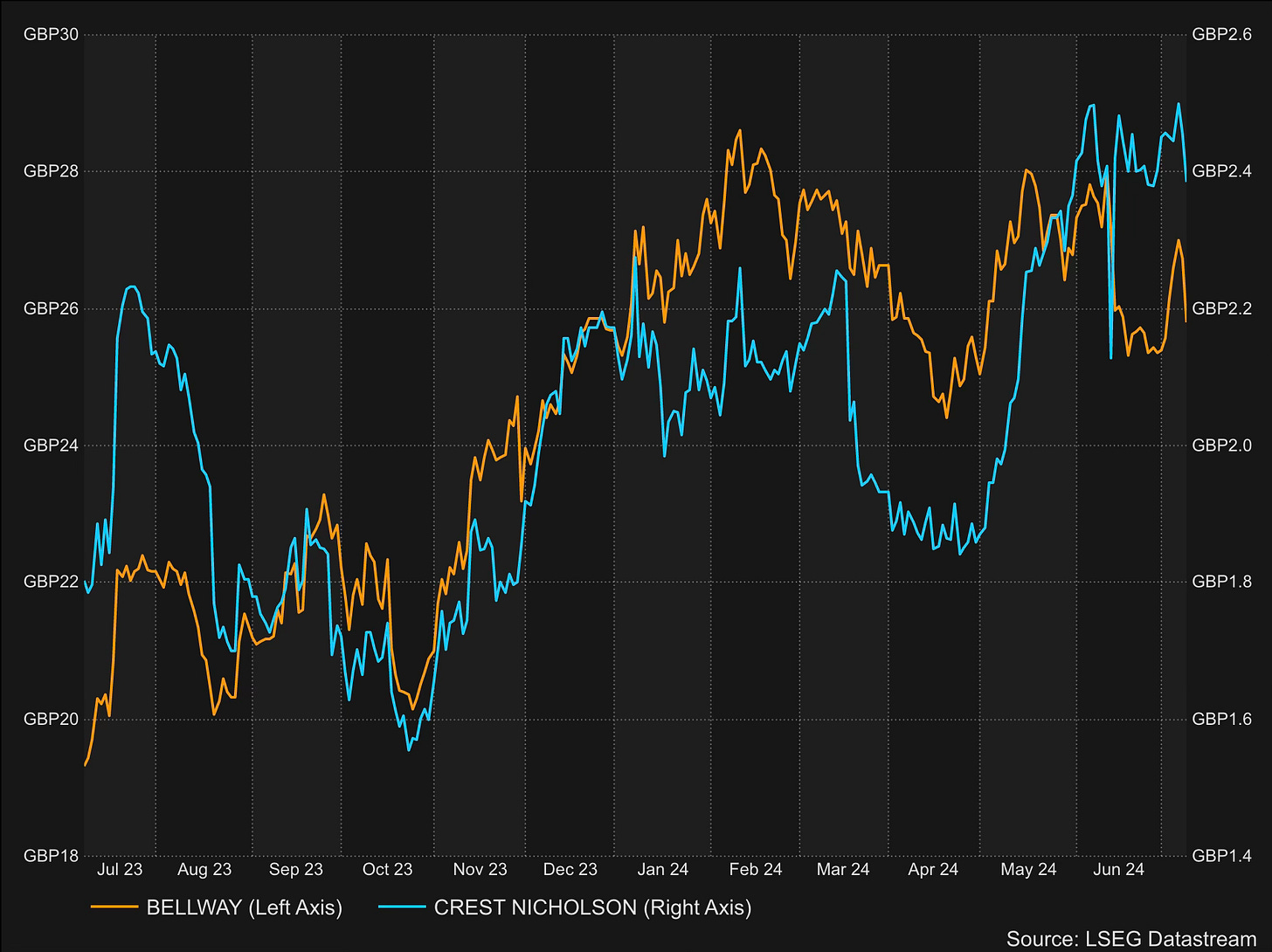

The ongoing takeover bid by Bellway p.l.c. for Crest Nicholson Holdings plc has generated significant market interest and reactions. As of July 11, 2024, here's an update on the latest developments and how the market is responding.

Market Reactions

Share Price Movements: Following the first announcement of Bellway’s latest offer, Crest Nicholson’s shares saw a significant increase, rising by as much as 15.46% to 250.6 pence, reflecting renewed investor confidence and speculation about the potential merger (Morningstar). Bellway’s shares, on the other hand, experienced a slight dip, falling by 3.38% to 2646 pence, indicating some investor caution about the deal's implications for Bellway (Evening Standard).

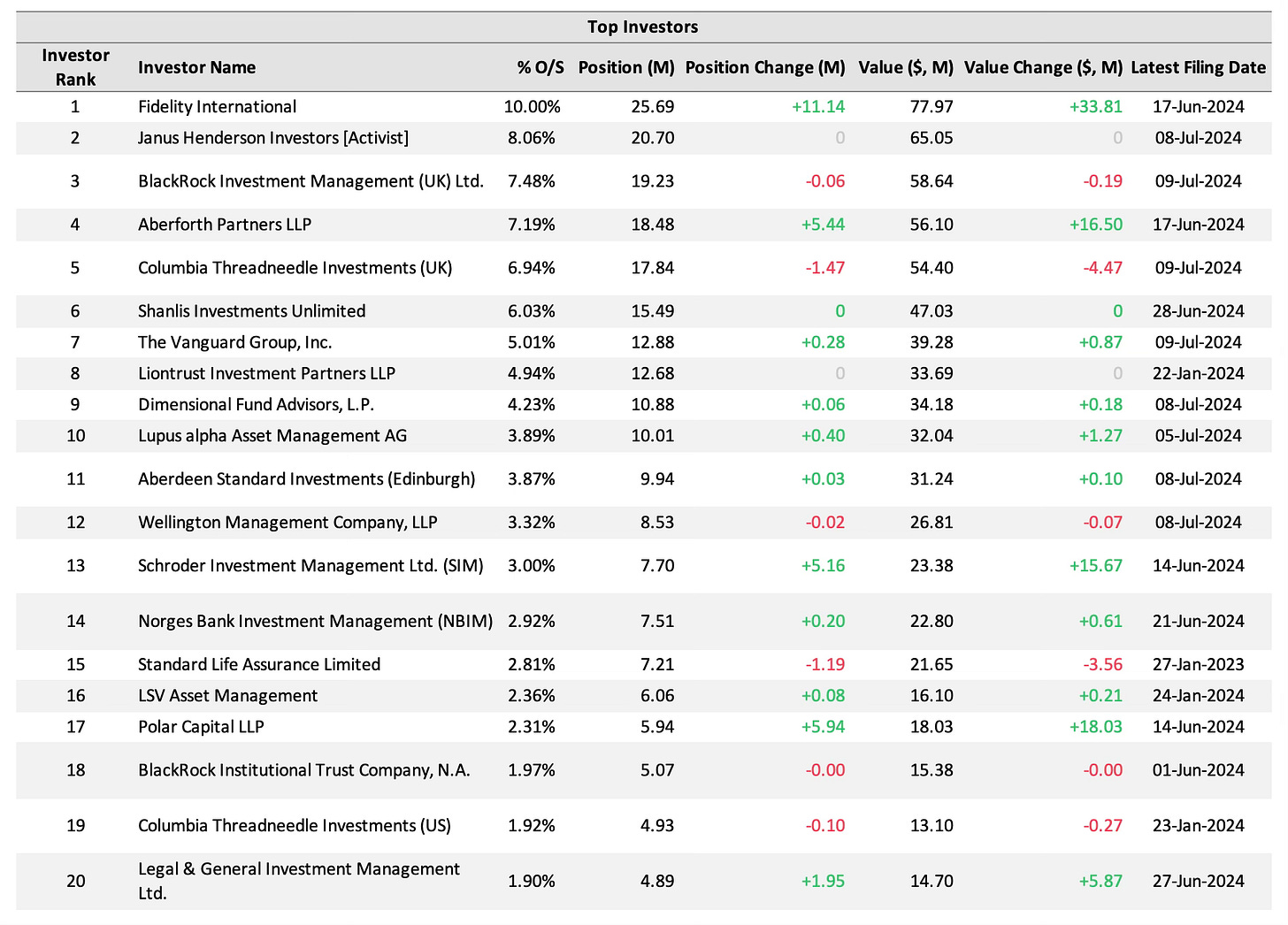

Analyst Opinions: Market analysts have generally viewed the proposed merger favorably. Analysts at Peel Hunt (IB), Schroders (CRST’s 3% shareholder), and Aberdeen (CRST’s 3.87% shareholder) highlighted the strategic sense of the merger, noting potential synergies and enhanced market positioning for the combined entity. They estimated savings of £25-30 million due to enhanced buying power and operational efficiencies (Yahoo Finance).

Shareholder Sentiment: The response from major shareholders has been mixed. Some investors in Crest Nicholson have expressed support for the merger, recognizing the strategic benefits and potential for enhanced shareholder value in the long term. Others remain cautious, concerned about whether the offer fully reflects Crest Nicholson’s intrinsic value and future growth potential (Evening Standard).

The following’s a table with the top 20 shareholders of Crest Nicholson:

Strategic Implications

For Crest Nicholson, the merger offers access to Bellway’s extensive operational infrastructure and financial resources, potentially accelerating growth and stabilizing profitability. For Bellway, acquiring Crest Nicholson enhances its land bank, diversifies its geographical footprint, and strengthens its market position (Morningstar). In general UK housebuilders are consolidating to expand their land banks ahead of a potential market upturn, which could happen once mortgage rates stabilise. The Labour party has pledged to reform the planning system to build 1.5m new homes in the next parliament.

6. Arbitrage Opportunities and Risks

Current Market Prices vs. Offer Price

The arbitrage spread is calculated as the difference between the offer price (273 pence) and today’s market price (251 pence), which is 22 pence per share. This represents a potential gain of approximately 8.76% for arbitrage investors.

Not much now… maybe by monitoring the situation the spread could widen further with new breaking news.

To assess the risk-adjusted return, investors should consider the likelihood of deal completion. For this reason I created a probability tree (chapter 7) that is based upon my assumptions and probability of similar past transactions. However, these considerations are very personal and I invite you to make your own based on the risk you are prepared to take.

Given these factors, the Bellway-Crest Nicholson deal offers an attractive arbitrage opportunity for investors with a higher risk tolerance and confidence in the merger’s evolution.

7. Possible Scenarios and Strategic Outcomes

To understand the possible outcomes of Bellway’s takeover bid for Crest Nicholson, it’s crucial to consider various scenarios, including the potential involvement of other interested acquirers. A probability tree helps visualize these outcomes and their associated probabilities, offering a structured approach to analyzing the strategic implications.

Probability Tree Analysis

Scenario 1: Bellway's Offer Accepted - Probability: 50%

Smooth Integration (45% Total Probability)

Achieves significant cost savings, operational efficiencies, and a stronger market position. Enhanced shareholder value through improved profitability and expanded market reach.

Impact: Increased EPS and market capitalization for the combined entity. Potential share price appreciation for both Bellway and Crest Nicholson shareholders.

Integration Challenges (5% Total Probability)

Operational disruptions, cultural conflicts, and cost overruns. Potential loss of key personnel and delays in achieving synergies.

Impact: Lower than expected financial performance, potential share price decline and investor dissatisfaction.

Scenario 2: Bellway's Offer Rejected - Probability: 40%

Independence Strategy (15% Total Probability)

Focus on leveraging existing assets and strategic initiatives to drive organic growth. Potential for better control over strategic direction.

Impact: Moderate growth, dependent on market recovery and successful execution of strategic plans. Share price stability or gradual appreciation.

Alternative Acquirer or Bellway’s Third Offer (25% Total Probability)

Potential for a higher bid from Bellway or another acquirer, providing better value to Crest Nicholson shareholders.

Impact: Immediate premium on share price, enhanced long-term growth prospects. Possible competitive bidding war increasing shareholder returns.

Scenario 3: Regulatory Intervention - Probability: 10%

Approval with Conditions (7% Total Probability)

Merger proceeds with regulatory oversight ensuring fair competition. Achieves most of the anticipated synergies with minor adjustments.

Impact: Achieves synergies with some delay and additional compliance costs. Share price impact moderated by regulatory conditions.

Merger Blocked (3% Total Probability)

Both companies must revert to standalone strategies. Loss of potential synergies and strategic advantages.

Impact: Short-term share price decline for both companies. Revaluation based on standalone prospects and market conditions.

Other Interested Acquirers

According to recent news, there are rumors of another potential acquirer showing interest in Crest Nicholson: Avant Homes. They are reportedly considering a bid that could rival Bellway's offer, providing Crest Nicholson shareholders with a potentially more lucrative option (BNN Bloomberg).

8. My Final Take

I personally believe (I recommend doing your due diligence, as always!) that this is an opportunity to monitor, as already said the 0.099x conversion into Bellway shares so the current arbitrage spread is subject to changes in the value of both securities. Therefore, based on the previous premises and my valuation of Crest Nicholson at £7.48, I believe that this possible acquisition by Bellway could be very profitable for them. They chose the right time to do it, a year in which the target value was completely knocked down due to the downturn in the UK property market, which is, however, slowly recovering. They are not performing better either, but on their side they have a more structured and solid financial position and are acquiring a company with a very strong land portfolio and some projects in the pipeline that will soon be on the balance sheet.

As explained in the chapter with the various scenarios I think we can consider mainly 3: the deal is approved by the shareholders going with the second offer, the deal is rejected by the shareholders permanently, there is a third upside offer.

If the deal is approved by shareholders following the second offer, the current spread would not justify short term arbitrage, if anything it would be more forward looking to participate in the conversion and hold the investment until the UK property market recovers and the intrinsic value of Crest is absorbed by Bellway combined with the synergies.

If the deal is rejected by the shareholders, the reaction could be a rapid decline in Crest's value, but then it would be the best time to strengthen the long-term position.

If a third upward bid comes in, the spread will certainly increase.

I will certainly return to this situation as soon as there is any news!

If you made it to the end I can only thank you! I hope you have found this article useful and enjoyed it, I will try to be as consistent as possible with the publication and when there are updates I will write another article.

If you would like to support me in this work I would be very glad to receive a like and if you would like to share the post you would give me an incredible contribution to make Strategic Alpha known to as many people as possible!

See you soon

Attilio

*Disclaimer

The information provided on Strategic Alpha - a Special Situations Gazette is for informational purposes only and should not be construed as financial advice. While I may hold positions in some of the stocks discussed, I do not take responsibility for any decisions made based on the content of this site. It is crucial for readers to conduct their own due diligence and consult with a professional financial advisor before making any investment decisions.

All logos and trademarks displayed in conjunction with this article are the registered trademarks or copyrighted properties of their respective owners, including but not limited to Crest Nicholson Holdings p.l.c. and Bellway p.l.c. The use of these logos and trademarks is intended solely for informational and illustrative purposes, and does not imply any endorsement, sponsorship, or affiliation with the respective companies. All rights to the logos and trademarks are retained by the respective trademark and copyright owners.