Today's deep dive is peculiar.

A company that is part of the S&P500. One of the most covered, well-known and relevant companies, particularly in the American healthcare sector.

I'm talking about CVS.

Hold up, hold up, I already know that you are thinking. Why would I want to talk about a company like this?

The motivation is very simple... CVS is almost trading at an all-time low for the last 10 years and I am sure you are wondering why.

To understand what is happening to CVS you only have to look at the moment when the share price fell like a rock... on May 1st.

Coincidentally on the day of the Q1’24 earnings call. (link to the presentation)

Well I'll tell you, at first I almost couldn't believe it.

The more I digged into data, analysed it and prepared this report, the more I realised that Wall Street analysts create some nonsense arbitrage situations just because of the lack of a time horizon longer than two quarters. They often forget how a business like that (which, spoiler, has become super-vertical in recent years as a result of non-stop acquisition activity) can be subject to different kinds of business cycles.

Some newspapers even called CVS a value trap, or rather ‘a Valentine's candy in March’.

For obvious reasons?! I see nothing obvious about it.

On the contrary, I hope that with this analysis I can demonstrate how with a little patience and a medium-term perspective, it is possible to arbitrage companies like CVS following Earnings Calls that are slightly off the mark.

Table of Contents

1. Executive Summary

2. Company Background and Business Model

3. Latest Earnings Call Analysis

4. Cyclicality of the Insurance Segment

5. Financial Performance and Valuation

1. Executive Summary

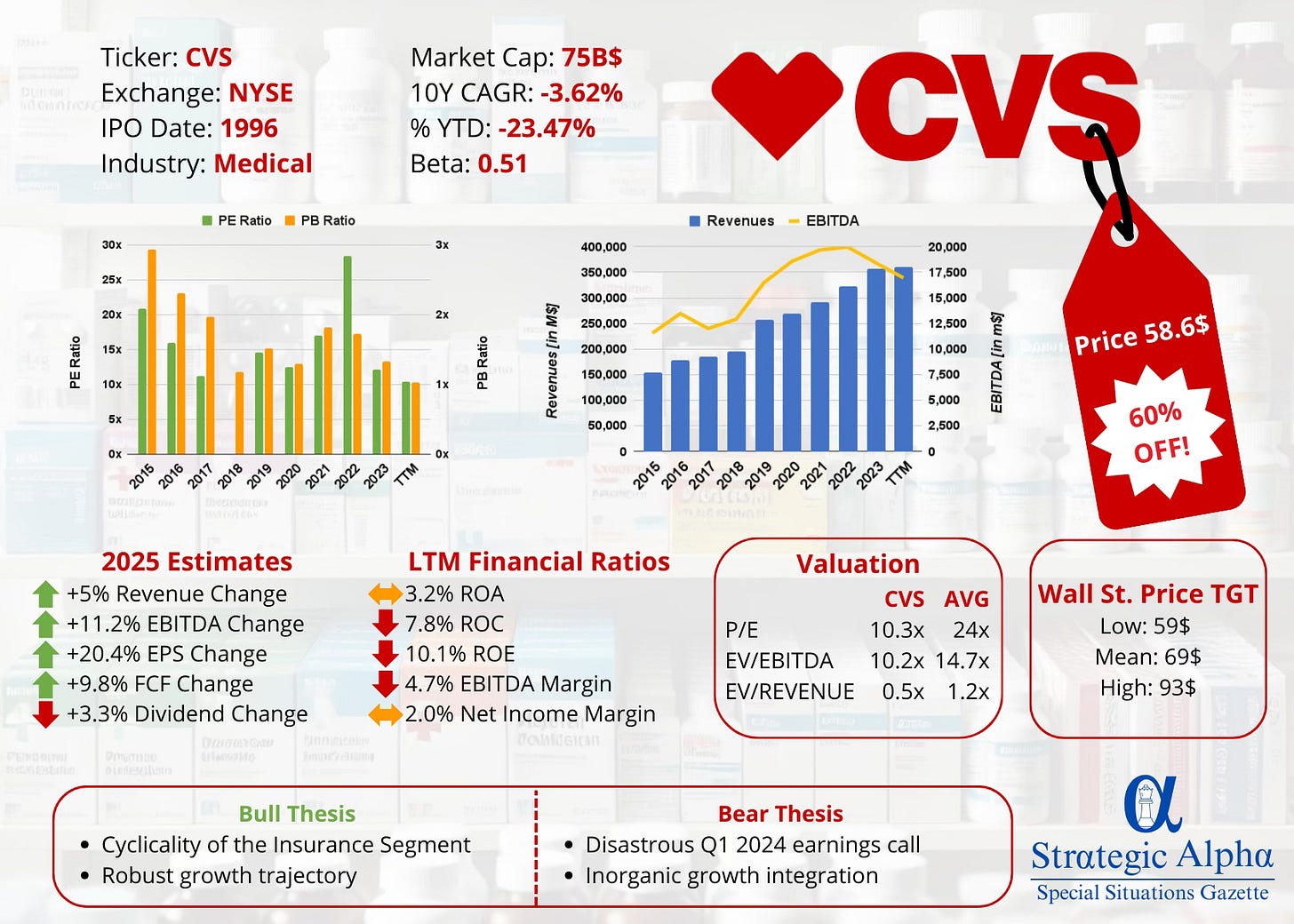

As of today, CVS Health's stock is trading at approximately $59 per share, with a market capitalization of around $74.7 billion. Trading at historically low valuation multiples, reflecting market concerns over short-term challenges. However, this undervaluation presents a compelling investment opportunity for long-term investors/arbitrageurs, like me!

CVS posted a Q1 operating profit of $1.31 a share, well below the FactSet average analyst forecast for $1.69. The culprits: higher Medicare Advantage costs and ongoing weakness in its pharmacy benefits unit and integration challenges from recent acquisitions.

However its strong revenue growth, robust cash flows, and strategic focus on digital health and value-based care position it well for long-term success, in my personal opinion.

Investors should consider both the near-term pressures (aka business cycles, in this case, more specifically, “insurance/underwriting cycle”) and the long-term growth prospects when evaluating CVS Health as an investment. The company’s management, commitment to innovation and integrated model offer significant potential for value creation over the coming years.

Just to give some context, here some key financial metrics:

My thesis is therefore based on these 6 fundamental points:

Market Overreaction: The market has overly penalised CVS for its recent earnings decline, driven primarily by elevated Medicare Advantage costs and issues within the PBM segment.

Cyclical Nature of Insurance: The insurance segment, particularly Medicare Advantage, is cyclical, with periods of higher costs typically followed by premium adjustments and improved profitability.

Strategic Initiatives: CVS is actively managing costs and integrating recent acquisitions like Aetna, Signify Health, and Oak Street Health, which are expected to drive long-term growth.

Revenue Growth: CVS has shown consistent revenue growth over the past five years, with total revenues reaching $357.8 billion in 2023.

Earnings Performance: Despite recent challenges, CVS continues to generate strong operating cash flows and maintains a robust dividend yield.

Valuation: The stock's current P/E ratio and dividend yield suggest significant undervaluation compared to industry peers and the broader market.

In a nutshell, CVS Health Corporation is well-positioned to leverage its integrated healthcare model and strategic focus to achieve sustainable growth. Despite near-term challenges, the company's robust financial performance, strategic initiatives, and attractive valuation make it a compelling investment opportunity for long-term value creation in the evolving healthcare landscape.

2. Company Background and Business Model

*A quick disclaimer, those who already know CVS can skip this chapter, but for the sake of completeness I have chosen anyway to explain what CVS is, its history and where it is headed.

History and Evolution of CVS Health

CVS Health Corporation, headquartered in Woonsocket, Rhode Island, has grown to become a leading health solutions company in the United States. Founded in 1963, the company initially focused on retail pharmacy services but has since expanded significantly through strategic acquisitions and organic growth.

Key milestones in CVS's evolution include:

1963: The first Consumer Value Store (CVS) opens in Lowell, Massachusetts, focusing on health and beauty products.

1996: CVS launches its pharmacy benefit management (PBM) segment through the acquisition of PCS Health Systems.

2007: CVS merges with Caremark Rx, Inc., transforming the company into a comprehensive pharmacy services provider.

2018: CVS completes a $69 billion acquisition of Aetna, a major health insurance company, significantly expanding its role in health care benefits.

2023: CVS acquires Signify Health and Oak Street Health, enhancing its capabilities in home health care and primary care services.

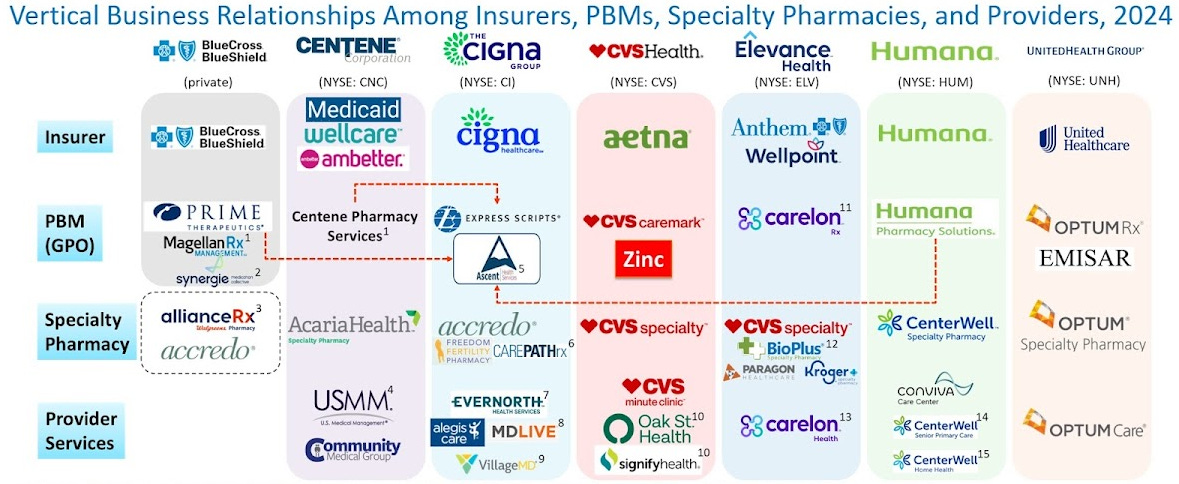

These strategic moves have positioned CVS Health as one of the few vertically integrated American healthcare giants, combining retail pharmacy operations with health insurance, pharmacy benefit management, and a growing presence in health services.

Detailed Breakdown of Business Segments

As anticipated by the above image, CVS operates on several fronts, with different margins and profits. (link to the Investor Fact Sheet)

We can define 4 main segments: Retail Pharmacy, Pharmacy Services (PBM), Health Care Benefits (Insurance), and Health Services.

Now it's time to get into the details, believe me, they will be crucial in solving the whole puzzle…

Retail Pharmacy

The retail pharmacy segment remains a cornerstone of CVS Health, with over 9,000 pharmacy locations across the United States. This segment generates less than 30% of the company's total revenue but plays a crucial role in its consumer engagement strategy. The retail pharmacy division benefits from prescription drug sales, over-the-counter medications, health and wellness products, and various retail items.

Pharmacy Services (PBM)

The Pharmacy Services segment, operated primarily through CVS Caremark, is the largest by revenue and serves as the backbone of CVS Health's integrated health care model. CVS Caremark provides pharmacy benefit management services, including prescription plan design and administration, formulary management, and mail-order pharmacy services. This segment caters to employers, insurance companies, unions, government employee groups, and managed care organizations, covering millions of lives across the country. The PBM business faces ongoing pressure from regulatory changes, market competition, and the need to manage drug costs effectively.

Health Care Benefits (Insurance)

The Health Care Benefits segment, significantly bolstered by the acquisition of Aetna, positions CVS Health as a major player in the health insurance industry. This segment offers a wide range of health insurance products, including medical, dental, and vision plans, as well as Medicare Advantage and Medicaid products. CVS has made substantial investments in Medicare Advantage plans, which are privately administered versions of the U.S. government's health plan for seniors. Despite facing higher costs and regulatory challenges, this segment continues to be a growth driver. As of the latest reports, CVS Health has over 26,8 million medical benefit members.

Health Services

The Health Services segment, a relatively newer addition to CVS Health's portfolio, focuses on providing health care services outside the traditional pharmacy setting. The acquisitions of Signify Health and Oak Street Health have enhanced CVS Health's capabilities in home health care and primary care services, respectively. This segment includes home health services, in-home health assessments, and value-based primary care centers, aiming to improve patient outcomes and reduce overall health care costs.

3. Latest Earnings Call Analysis

Ready to find yourself with your jaw hanging open?

CVS Health Corporation's Q1 2024 earnings call on 1 May 2024 was the trigger event for the stock's fall of about 185 basis points on the NYSE.

During the event, key executives, including President and CEO Karen S. Lynch and CFO Thomas F. Cowhey, presented the results and addressed investor concerns.

CVS reported total revenue of $88.4 billion in the first quarter of 2024, an increase of 3.7% from the same quarter a year earlier. Not bad for organic growth.

However the drugstore chain expects 2024 adjusted earnings of at least $7 per share, down from a previous guidance of at least $8.30 per share. Analysts surveyed by LSEG were expecting full-year adjusted profit of $8.28 per share.

CVS also cut its unadjusted earnings guidance to at least $5.64 per share, down from at least $7.06 per share.

So what about segments performances?

Health Care Benefits faced significant headwinds, with a Medical Benefits Ratio (MBR) of 90.4%, up from 84.6% in Q1 2023. The increase in MBR was primarily due to higher-than-expected Medicare Advantage utilization, impacting segment profitability.

Pharmacy Services experienced a decline in operating income, affected by the loss of a major client and challenges from the Oak Street Health acquisition.

Retail Pharmacy showed resilience, with increased prescription volumes and improved drug purchasing, partially offsetting pressures in other areas. Same-store sales and prescription volumes increased by approximately 7% and 6%, respectively.

Management emphasized ongoing efforts to manage costs, particularly in the Medicare Advantage business. Adjustments in premiums and operational efficiencies are key focus areas to improve margins over the next few years. Investments in digital health and technology remain a priority. CVS highlighted initiatives like CVS Caremark TrueCost™ and CVS CostVantage™, which aim to provide more transparent and cost-effective pharmacy services.

Analysts have expressed mixed views, with some downgrading the stock due to short-term challenges, while others recognize the long-term value proposition.

4. Cyclicality of the Insurance Segment

Reading the earnings call, it is clear what caused these unexpected results. In this chapter I will also try to give my two cents.

CVS Health's insurance business, significantly bolstered by the acquisition of Aetna in 2018, has become a critical component of its diversified healthcare model. This segment, known as Health Care Benefits, includes a wide range of health insurance products and services, such as medical, dental, vision plans, Medicare Advantage, and Medicaid products. The strategic aim of integrating Aetna was to create synergies across CVS's retail, PBM, and insurance businesses, providing a more comprehensive healthcare solution to customers.

What is missing among biased analysts is that the insurance business is inherently cyclical, with periods of higher costs followed by adjustments that lead to improved profitability. Several factors drive these cycles, including regulatory changes, healthcare utilization trends, and economic conditions.

Healthcare utilization rates fluctuate based on demographic shifts, disease prevalence, and broader economic factors. During periods of higher utilization, such as increased claims from Medicare Advantage members seeking more care, insurers face elevated costs. Conversely, during periods of lower utilization, insurers can achieve better margins. CVS's recent experience with elevated Medicare utilization is a clear example of this cyclicality.

For instance, in Q1 2024, the MBR for Medicare Advantage rose to 90.4%, up from 84.6% in the previous year.

There is a solution, however, and it is trivial for CVS: tailor premiums to reflect rising costs!

And as dear old Warren B. teaches, insurance cycles usually last for a couple of years, so when the cycle that is currently dogging CVS is reversed, it is likely that premiums will over-collect, leading to an easy and painless increase in profits

Not surprisingly CVS’s management has indicated a plan to return to target margins within three to four years, focusing on cost management and operational efficiencies.

I add one last provocation to this section... there must be a reason that despite the disastrous earnings call for analysts, their models continue to predict outstanding growth for the next few years. For 2026 they predict an EPS of $9.06... what game are we playing here?

5. Financial Performance and Valuation

As the saying goes, numbers don’t lie, but they can be misinterpreted, especially when analysts get blinded by quarterly earnings. Let's embark on a five-year deep dive to unravel the true story behind CVS's stock performance and highlight how myopic earnings-focused evaluations have painted a misleading picture.

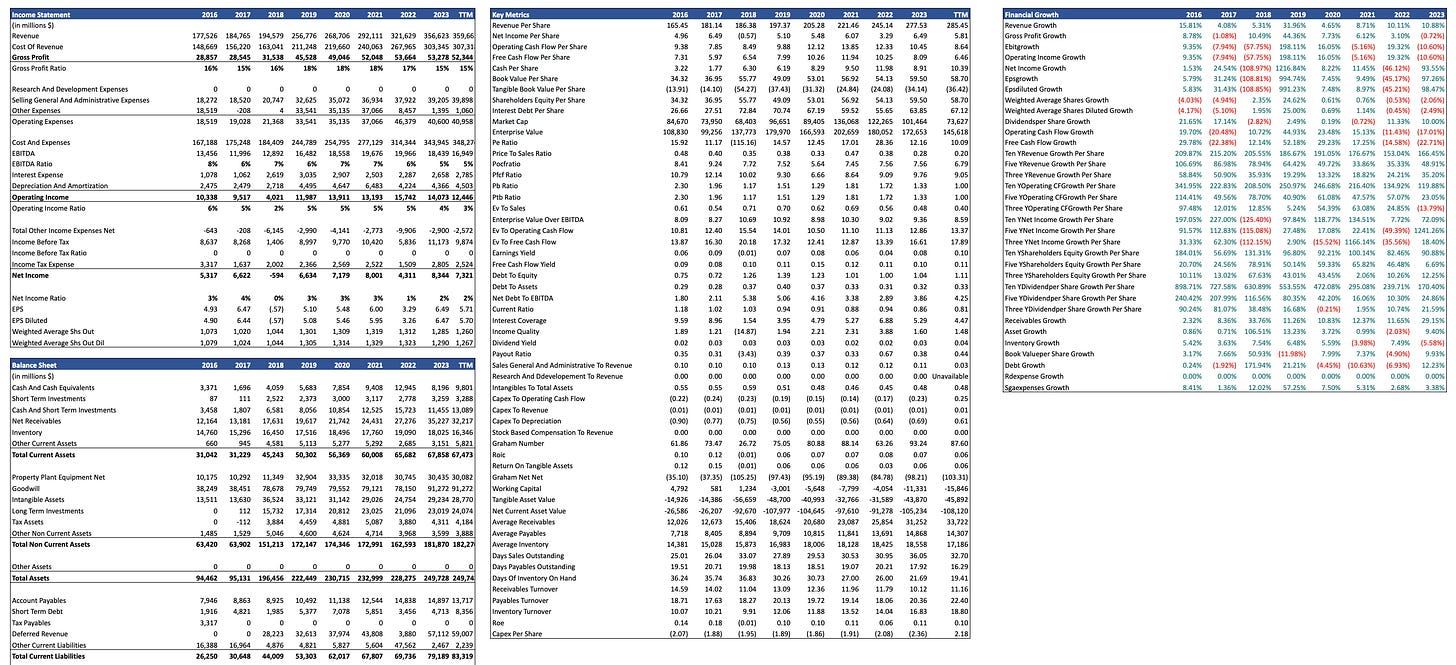

From 2019 to 2023, CVS’s revenue climbed from $256.8 billion to $356.6 billion, sporting a robust growth trajectory. This 39% increase wasn’t a fluke but the result of strategic acquisitions and organic expansion. While analysts fretted over quarterly blips, they seemed to have missed the broader narrative of consistent revenue growth driven by diversification into health services and insurance through acquisitions like Aetna. Each year saw incremental gains, with revenues rising by roughly 10% annually until 2022, slowing slightly to a 1% growth in 2023 due to reasons explained above.

The Devil in the Details

Despite impressive revenue growth, CVS’s profit margins tell a different story. The gross profit margin shrank from 18% in 2019 to a modest 15% in 2023. What they often fail to contextualize is the increased costs associated with integrating massive acquisitions and the investments in expanding service offerings. The net income margin remained relatively stable around 2-3%, except for a notable dip to 1% in 2022, which was a year marked by extraordinary expenses. Guess which ones… yet, when you peel back the layers, the EBITDA margin held steady around 5%, a sign of good operational strength.

The Earnings Per Share (EPS) journey has been a bumpy one, providing ample fodder for alarmist headlines. From a high of $6.49 in 2023, EPS dipped to a negative in certain years, only to bounce back. Such volatility is a magnet for short-sighted critiques, but it’s essential to recognize the context: large-scale acquisitions, debt servicing, and integration costs. These are temporary impediments in a long-term growth narrative. The real story lies in the resilience to rebound and maintain shareholder value through dividends and buybacks, despite these hurdles.

Amidst the noise around earnings, the free cash flow (FCF) has been an uncapped hero, quietly supporting CVS’s financial stability. FCF soared from $10.3 billion in 2019 to $15.7 billion in 2021, before stabilizing around $10.4 billion in 2023. This cash generation capability is a testament to CVS’s robust operational model, enabling it to weather financial storms, pay dividends, and invest in growth. Analysts often overlook this cash flow prowess, focusing instead on transient EPS figures.

Debt - A Necessary Evil

CVS’s debt levels have been a focal point of analyst scrutiny and not without reason. The total debt peaked post-Aetna acquisition, hitting $79.4 billion in 2023. While this debt load is hefty, it’s a strategic necessity for funding growth through acquisitions. The net debt to EBITDA ratio, though high at around 4.25, reflects a calculated risk rather than reckless borrowing. It’s crucial to note that CVS has been diligently paying down debt, a narrative that often gets lost in the cacophony of earnings calls.

Valuation Metrics: The Real Deal

Wall Street's fixation on quarterly earnings often leads to undervaluation. CVS’s P/E ratio stood at a mere 10.23 in 2023, compared to industry peers averaging around 15-20. This disparity screams opportunity for savvy investors who can see beyond the myopia of quarterly earnings. With a dividend yield of 4.38% in 2023, CVS offers not just growth but also income, making it a compelling case for value investors.

DCF Valuation: The Long View

A Discounted Cash Flow (DCF) analysis, considering conservative, base, and optimistic scenarios, reveals an intrinsic value significantly higher than the market price. Even in an ultra conservative case, factoring in a 2.5% revenue growth, a 2.5% EBIT margin and a 1% TGR, the intrinsic value per share comfortably sits above current levels.

Now you do the maths. I’ve done mine, I guess we'd better stop for today.

See you on the next research!

I hope you enjoyed this one 🙂

Attilio

If you made it to the end I can only thank you! I hope you have found this article useful and enjoyed it, I will try to be as consistent as possible with the publication and when there are updates I will write another article.

If you would like to support me in this work I would be very glad to receive a like and if you would like to share the post you would give me an incredible contribution to make Strategic Alpha known to as many people as possible!

This is not investment advice. See the disclaimer for details.