In April the commercial real estate data giant CoStar Group made headlines with a bold move: the acquisition of Matterport, a leader in 3D spatial data and virtual tour technology.

Why did CoStar decide to invest $4 billion (50% equity & 50% shares) in Matterport, and what does this acquisition mean for the future of both companies?

Who Are Matterport and CoStar?

Matterport (link) is at the forefront of the 3D spatial data revolution. Founded in 2011, the company has transformed how we visualize and interact with physical spaces. Their technology captures detailed 3D models of environments, allowing users to explore virtual spaces as if they were physically present. Matterport's platform is used for a wide range of applications, from real estate listings to architectural planning and facility management. But what makes Matterport so special? The answer lies in its innovative technology and the growing demand for immersive digital experiences.

CoStar Group (link) is a giant in the commercial real estate information sector. Established in 1987, CoStar has built a reputation as the go-to provider of real estate data, analytics and marketing services. With a vast database that includes millions of commercial real estate properties, CoStar serves a diverse client base ranging from real estate professionals to investors and analysts. Their comprehensive data solutions help users make informed decisions and drive business growth.

How does a company known for its data and analytics see value in Matterport’s 3D technology?

The answer to this question is crucial for understanding the rationale behind the acquisition.

The Significance of the Acquisition

On the surface, this $4 billion acquisition might seem like a straightforward expansion into new technological territory. However, the implications of this deal are far-reaching. CoStar’s decision to acquire Matterport reflects a strategic vision to integrate advanced technology with their traditional data-centric business model.

But what drove CoStar to pursue such a high-stakes acquisition?

Let’s delve into a few important aspects:

Expansion of Service Offerings: by acquiring Matterport, CoStar gains access to cutting-edge 3D imaging technology that can enhance their existing real estate data services. Imagine being able to offer clients not just data and analytics, but also immersive virtual property tours and detailed 3D models.

Reinforce Market Position: CoStar’s acquisition of Matterport positions it as a leader in both data and technology in the real estate sector. It’s not just about expanding their portfolio, but about setting new standards for the industry.

Strategic Synergies: the merger aims to create synergies between CoStar’s extensive database and Matterport’s advanced 3D technology.

Setting the Stage for a Deep Dive

In this article, we will explore the many facets of this acquisition. We’ll start with a detailed look at the companies involved, examining their histories and market positions. We will break down the specifics of the acquisition deal, analyse the opportunities and risks of the merger arbitrage, and explore the strategic implications for the future. We will also dive into regulatory concerns and potential legal challenges, assess the long-term value for investors, and consider the broader impact on the real estate and technology sectors.

Company Backgrounds

Matterport: Pioneers of 3D Spatial Data

Matterport, founded in 2011, has carved a niche for itself in the world of 3D spatial data and virtual tour technology. By leveraging advanced 3D imaging, Matterport enables users to create digital twins of physical spaces, transforming how we interact with and visualize real estate properties. Their platform is a favorite among real estate professionals, architects, and facility managers, offering a unique blend of hardware and software solutions.

But what makes Matterport stand out in a crowded market?

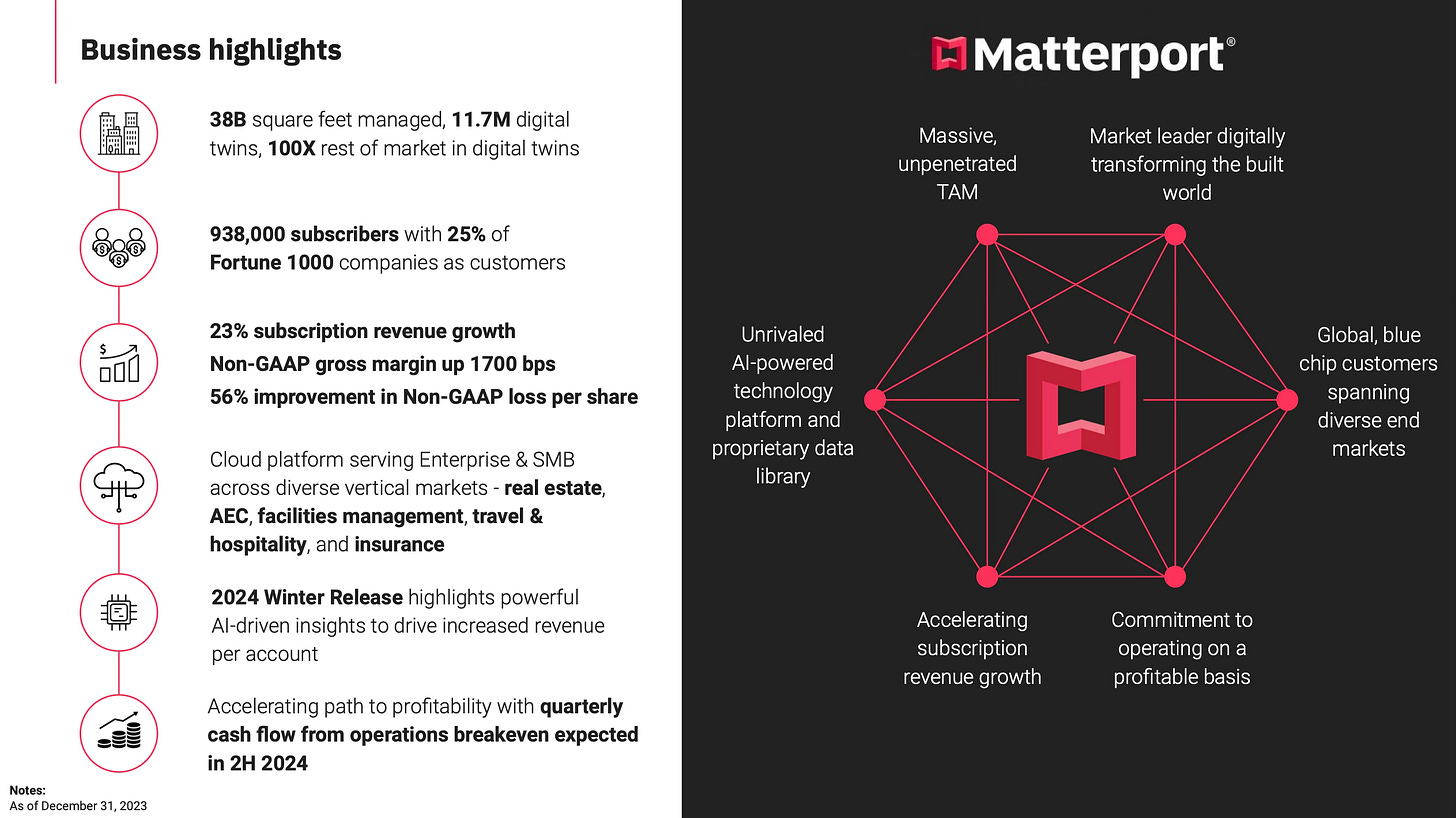

At the core of Matterport's success is its proprietary technology. The company’s 3D cameras and software allow users to capture detailed spatial data and create immersive, interactive 3D models of any environment. This technology is particularly popular in the real estate sector, where virtual tours have become a critical tool for marketing properties. But Matterport's reach extends beyond real estate into industries such as construction, insurance, and hospitality.

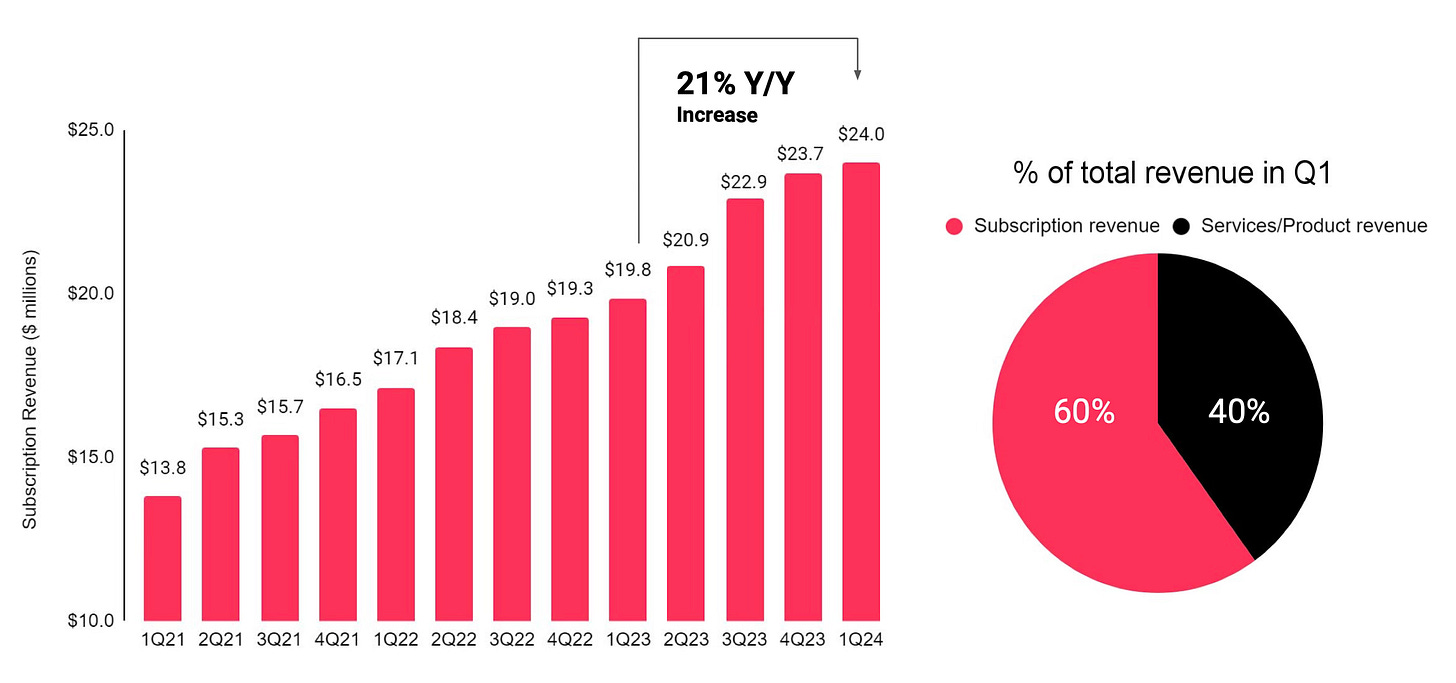

Matterport has demonstrated impressive growth over the past few years. According to their latest corporate presentation, the company has seen revenue growth rates of 16%-29% annually from 2021 to 2023. However, despite this growth, Matterport remains unprofitable, with ongoing investments in technology and market expansion. Their gross margins have consistently stood above 40%.

Matterport’s dominance in the 3D imaging space is reflected in its extensive customer base and widespread adoption of its technology. From residential real estate listings on platforms like Zillow and Homes.com to commercial applications in facility management and construction, Matterport’s technology is ubiquitous. How does Matterport maintain its competitive edge? The answer lies in continuous innovation and a robust subscription-based revenue model.

Competitive Advantages

Matterport stands out in its field due to several competitive advantages that set it apart from its rivals.

Here’s a look at the competition and how Matterport maintains its edge (If you want to go in further depth with the competitive advantages of Matterport, have a look at this article from which I have taken the core info):

Metareal mimics many of Matterport's main features like the dollhouse view and creates floor plans and 3D virtual tours from 360 photos. However, Metareal lacks a mobile app and does not support phone shooting, making it more suitable for users skilled in 3D modeling. Although their hosting plans appear cheaper, they charge high fees for building 3D tours.

Asteroom provides an all-in-one 3D tour solution, including a mobile app that allows phone shooting. They offer tour-building services for a fee, which includes hosting for 180 days with additional costs for extended hosting. Despite these features, their pricing is higher than Matterport’s for comparable services.

Cupix markets itself as an advanced 3D digital twin platform, mainly serving the construction industry. While they have a 3D tour solution, it is more expensive than Matterport’s and limited to certain 360 cameras.

EyeSpy360 transforms 360 photos into 3D tours and floor plans manually, charging processing and monthly subscription fees. They also offer professional space capturing services, which are more costly than Matterport’s offerings.

Zillow 3D Home Tour provides a DIY solution with basic features, free for Zillow subscribers but limited to use within the Zillow platform in the US.

Additionally, major tech companies like Nvidia, Microsoft, and Amazon have complex virtual world solutions targeted at large enterprises, differing significantly from Matterport’s focus.

Matterport maintains its competitive edge through its first-mover advantage, having been in the market for over a decade. This has allowed them to amass nearly half a million subscribers and manage over 6 million spaces, far exceeding the rest of the market combined. Their extensive library of spatial data continues to grow daily, creating strong network effects that enhance their platform's value.

The massive spatial data library itself is a significant advantage that is difficult for competitors to replicate. Matterport also holds 38 issued patents and 28 pending patents on capture technology, supporting a wide range of capture devices that no other company in the space can match.

CoStar Group: The Data Powerhouse

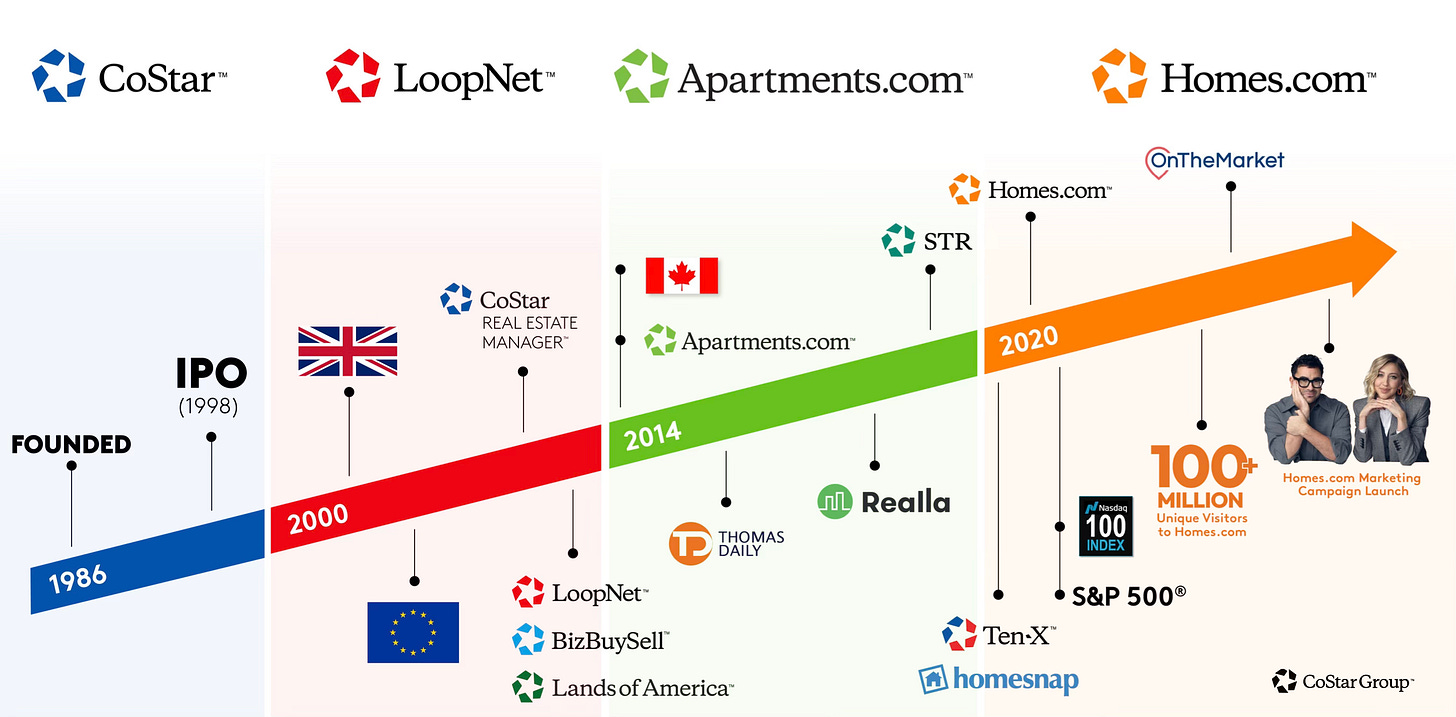

CoStar Group, established in 1987, has grown into a leading provider of commercial real estate information, analytics, and marketing services. With a market capitalization of $34 billion, CoStar is a top player in the real estate sector.

What drives CoStar’s sustained success?

CoStar's business model revolves around providing high-quality, accurate real estate data and analytics. Their platforms, such as LoopNet and Apartments.com, are essential tools for commercial and residential real estate transactions. By continuously updating and expanding their database, CoStar ensures that clients have access to the most current and comprehensive market information.

How has CoStar maintained its leadership position for over three decades?

It’s a combination of strategic acquisitions and a relentless focus on data quality.

Notable acquisitions include LoopNet in 2012, Apartments.com in 2014, and more recently, Homes.com in 2021. Each of these acquisitions has allowed CoStar to expand its service offerings and market reach. For instance, LoopNet has grown its revenue nearly fourfold since being acquired, and Apartments.com has become a leader in the residential rental listings market.

CoStar’s financial performance is a testament to its robust business model. With a strong revenue base and healthy profit margins, CoStar has consistently delivered value to its shareholders. Their ability to generate substantial cash flows has enabled continued investment in technology and market expansion. As of the latest reports, CoStar is trading at a high earnings multiple, reflecting market confidence in its growth prospects.

Timeline of the Matterport Acquisition by CoStar

May 2023: initial contact

Andrew Florance, CEO of CoStar Group, initiated contact with RJ Pittman, CEO of Matterport, to discuss potential collaborations and future opportunities.

June 2023: follow-up discussions

Florance and Pittman continued their discussions, with CoStar expressing interest in acquiring Matterport. Initial discussions were exploratory, with no formal offers made.

September 2023: initial acquisition proposal

CoStar submitted an unsolicited acquisition proposal offering $4.20 to $4.60 per share. Matterport’s Board reviewed the proposal and began evaluating its merits.

October 2023: due diligence begins

Matterport engaged Qatalyst Partners as their financial advisor. Both companies conducted due diligence, with extensive discussions on strategic synergies and potential value creation.

November 2023: ongoing negotiations

Discussions continued, with CoStar working on a revised valuation. No formal updated proposal was received during this period, but the groundwork for a higher offer was laid.

December 2023: revised proposals

CoStar presented an updated offer of $4.50 to $5.00 per share. Matterport countered, suggesting a valuation of $6.85 per share. CoStar indicated a willingness to propose $5.50 per share.

January 2024: final negotiations

CoStar made a final offer of $5.50 per share. Matterport’s management indicated support for this price, and discussions focused on finalizing terms.

February 2024: letter of intent

CoStar delivered a non-binding letter of intent proposing $5.50 per share, consisting of $2.75 in cash and $2.75 in CoStar stock. Matterport’s Board approved the letter of intent, subject to certain revisions.

March 2024: final due diligence

CoStar requested and was granted an extension to complete due diligence. Legal teams from both companies worked on finalizing the Merger Agreement.

April 2024: agreement approval and announcement

Matterport’s Board unanimously approved the Merger Agreement. The transaction was publicly announced, with a special meeting of Matterport’s stockholders scheduled for July 2024 to vote on the merger.

Terms of the Merger Agreement

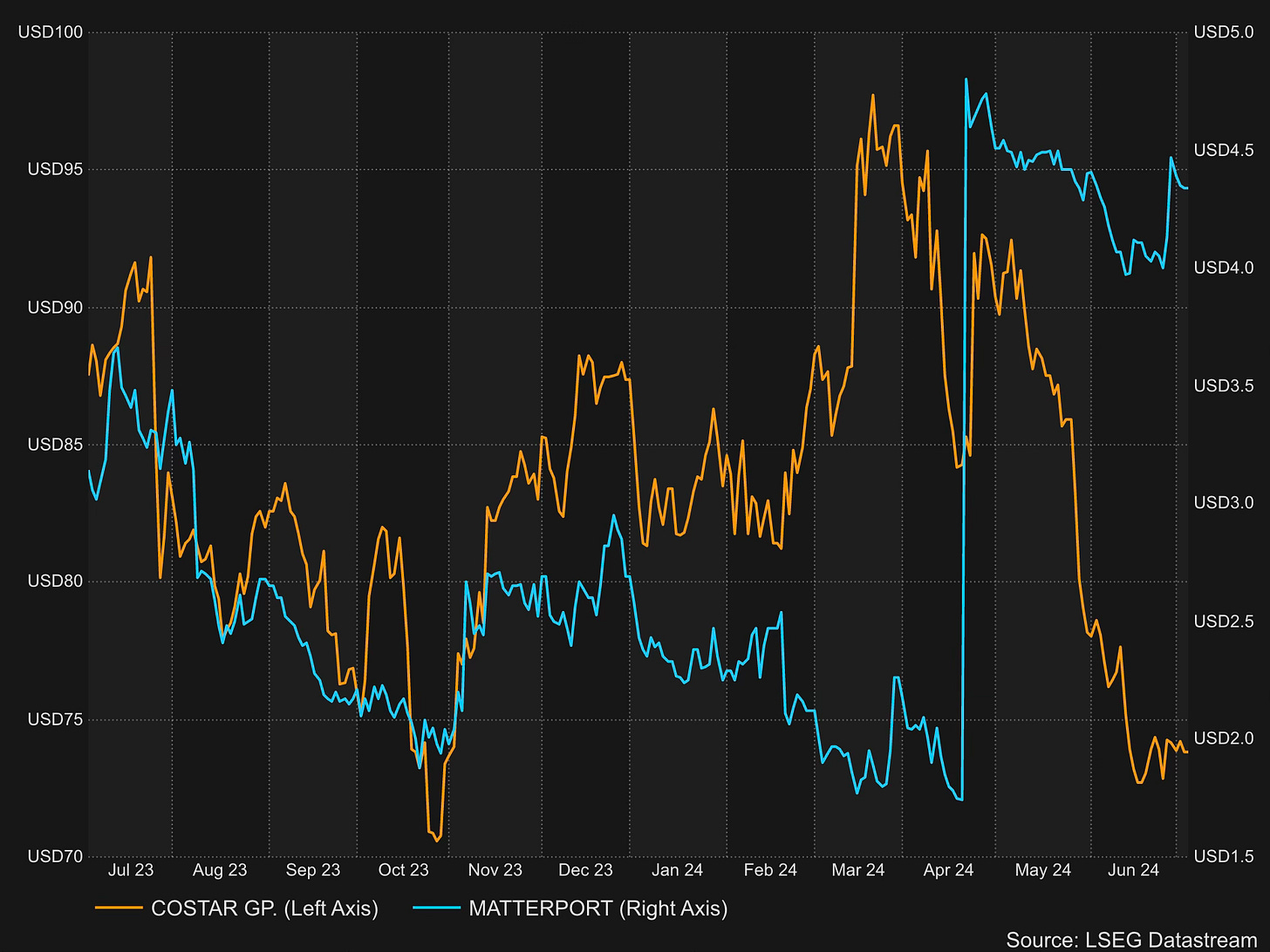

The merger consideration comprised $2.75 per share in cash and $2.75 per share in CoStar stock. A key feature of the merger agreement was the symmetrical collar on the stock portion of the consideration. This mechanism was put in place to protect Matterport shareholders from significant fluctuations in CoStar’s stock price.

Regulatory and Legal Considerations

Antitrust Scrutiny

Given CoStar’s dominant market position, the acquisition attracted significant regulatory scrutiny. The FTC and DOJ were particularly interested in assessing the potential impact on competition in the real estate data and technology markets. Both companies engaged in extensive discussions with regulators to address any concerns and ensure compliance with antitrust laws.

In recent days, news has circulated that the FTC has requested more information from CoStar and Matterport.

The effect of the second request is to extend the waiting period of the HSR Act until 30 days after the companies have substantially complied with the request.

The disclosure comes after CoStar last month voluntarily withdrew and refiled its HSR notification.

Legal Challenges

Matterport faced several ongoing legal issues at the time of the acquisition. Notably, there were lawsuits related to patent infringements and shareholder disputes. During the merger negotiations, CoStar initially sought to reduce cash consideration to account for potential litigation losses but ultimately agreed to proceed with the original terms after evaluating the risks.

William Brown Lawsuit (link): Matterport was sued by a former manager over stock transfer restrictions, resulting in a recent $79 million court award in favour of the plaintiff.

SPAC Transaction Litigation (link): two stockholders have filed a lawsuit against Matterport’s management, claiming breaches of fiduciary duties in issuing earn-out shares during the SPAC transaction. This case is in early stages and unlikely to be resolved before the merger closes.

Patent Infringement Case (link): Matterport agreed to indemnify Redfin in a lawsuit alleging patent infringement by Surefield. While the initial trial found no infringement, ongoing post-trial motions keep this litigation active.

Analysis of the Current Spread

As outlined in the pitch, the merger consideration is $5.5 per share, consisting of $2.75 in cash and $2.75 in CoStar stock. With Matterport's stock trading at $4.30, the potential upside for arbitrage investors is substantial.

The exact spread at various CoStar stock prices, considering the symmetrical collar mechanism, is detailed below:

If CoStar stock is between $77.42 and $94.62

The exchange ratio is adjusted based on CoStar's 20-day VWAP.

If CoStar stock exceeds $94.62

The exchange ratio is fixed at 0.02906 CoStar shares per Matterport share.

If CoStar stock falls below $77.42

The exchange ratio is fixed at 0.03552 CoStar shares per Matterport share.

One of the primary risks in this arbitrage opportunity is the potential fluctuation in CoStar’s stock price (but also the as yet undefined deadlines for finalisation of the deal). Given the collar structure, any significant decline in CoStar’s stock below $77.42 would reduce the value of the stock portion of the consideration. However, as noted in the article, CoStar's stock would need to drop over 30% for this arbitrage to lose money.

A Random Walk - Monte Carlo Simulation

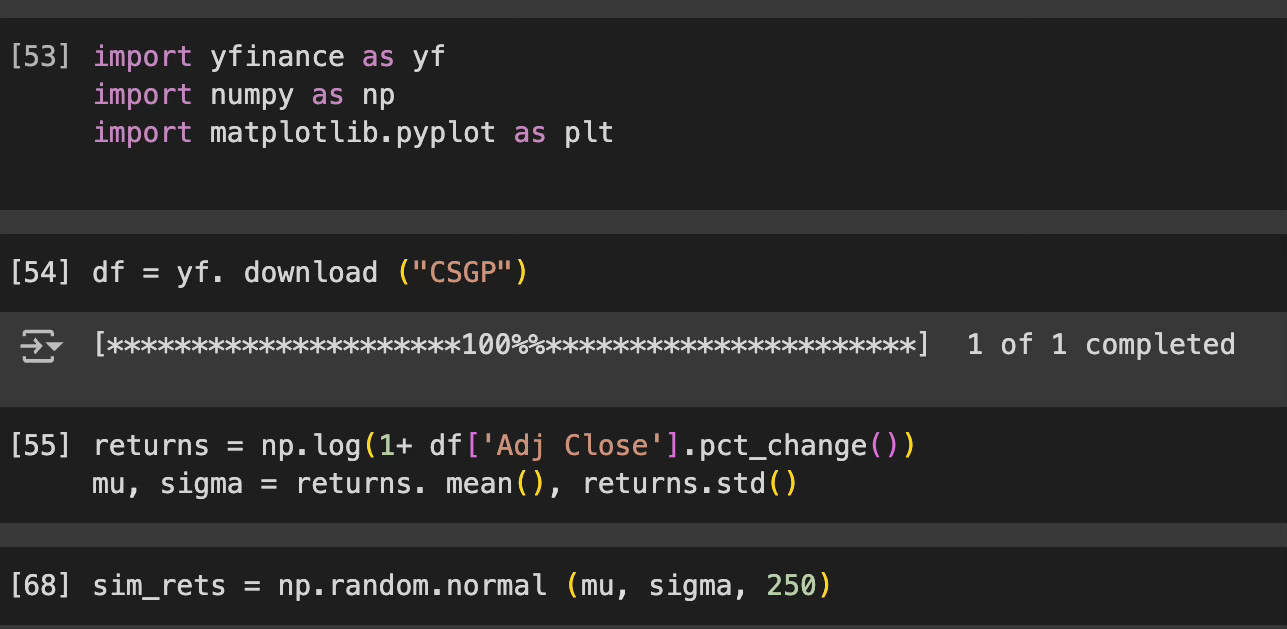

To enhance the analysis of the Matterport acquisition by CoStar, I developed a Monte Carlo simulation based on the random walk theory, setting hypothetically the deal closing date to January 2, 2025. This simulation predicts potential future stock prices of CoStar by simulating numerous random price paths (using the Brownian motion, sounds like nerd stuff... and it does indeed), providing a probabilistic outlook on the stock's performance.

The results of the Monte Carlo simulation indicate a range of possible CoStar stock prices at the time of deal closing.

Using the simulation results, we can better understand the likelihood of different price scenarios and their implications on the merger consideration.

For readers interested in exploring these simulations further or customizing the assumptions, the code for the Monte Carlo simulation is available here in a collaborative online environment! This allows for personalised adjustments and deeper analysis tailored to individual perspectives and market outlooks.

Upcoming Important dates

Matterport Shareholder Meetings

Date: Scheduled for July 26, 2024

Approval Needed: Majority of the shares represented in person or by proxy

The outcomes of this vote will be crucial in determining whether the acquisition proceeds as planned. The anticipation of this meetings has kept investors alert, with many analysts expecting strong support given the strategic fit and potential synergies of the merger.

My Final Take

I personally believe (I recommend doing your due diligence) that this is an excellent opportunity to get into the Matterport shareholder base. Based on the premise that I really like Matterport and believing that in the next few years if not months they can come up with great results (I used their services after renovating my property and listing it on the market...I was very impressed and pleased with the results), I believe that although the current prices are much higher than the $2 or so in April, the chance to receive $2.75 and the other half in CoStar shares is a great opportunity to get in now.

If the deal goes through, I will have earned a nice spread and the chance to join CoStar (a fantastic company from a financial point of view) and continue to enjoy their inorganic growth.

If the deal doesn't go through Matterport's prices will drop dramatically (probably more than 60% right after the the abort announcement) and at that point I will level off the position by buying more shares at a discount by averaging down.

If you made it to the end I can only thank you! I hope you have found this article useful and enjoyed it, I will try to be as consistent as possible with the publication and when there are updates I will write another article.

If you would like to support me in this work I would be very glad to receive a like and if you would like to share the post you would give me an incredible contribution to make Strategic Alpha known to as many people as possible!

See you soon

Attilio

*Disclaimer

The information provided on Strategic Alpha - a Special Situations Gazette is for informational purposes only and should not be construed as financial advice. While I may hold positions in some of the stocks discussed, I do not take responsibility for any decisions made based on the content of this site. It is crucial for readers to conduct their own due diligence and consult with a professional financial advisor before making any investment decisions.

All logos and trademarks displayed in conjunction with this article are the registered trademarks or copyrighted properties of their respective owners, including but not limited to Matterport Inc. and CoStar Group Inc. The use of these logos and trademarks is intended solely for informational and illustrative purposes, and does not imply any endorsement, sponsorship, or affiliation with the respective companies. All rights to the logos and trademarks are retained by the respective trademark and copyright owners.