Topgolf Callaway Brands Corp. ($MODG)

Exploring the Growth Potential and Spin-Off Opportunity That Could Unlock MODG’s True Value

4 Minute Read

Today we talk about Golf.

Whether you think a “birdie” is just a cute animal or know exactly how to use a 9-iron, there’s one thing you’ll understand—TopGolf Callaway Brands (the #1 name in golf equipment, and not only) is gearing up for something big.

Why MODG Is a Special Situation

Breaking Down MODG

The Spin-Off Opportunity

Financial Overview and Sum-of-Parts Valuation

Catalysts

Why MODG Is a Special Situation

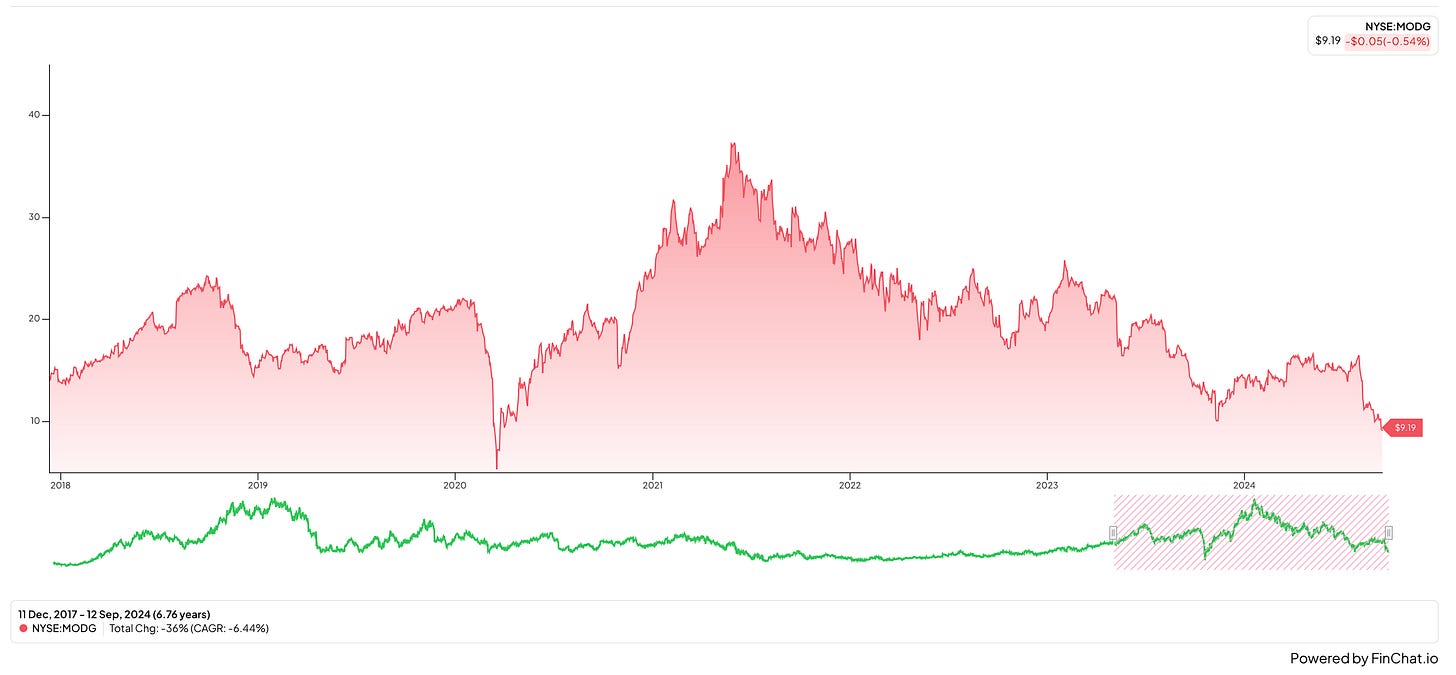

Topgolf Callaway Brands Corp. (MODG) has seen its stock tumble from its mid-2021 highs in the $30s to recent lows near $10.

This decline wasn't just due to the post-pandemic challenges, but also to the market's lack of interest in small caps and non-tech sectors. However, this underperformance sets up the potential for a potentially significant comeback.

In September 2024, MODG announced a significant restructuring that will separate its Topgolf business from its golf equipment and activewear lines. We'll explore what Topgolf is in a moment, but for now it's important to note that Topgolf is a cash-generating machine with global expansion plans, and Callaway's equipment division remains a steady performer. Splitting the two allows each business to thrive independently, attracting different types of investors and leveraging their respective strong assets.

The key question is: can MODG unlock the value the market has overlooked?

Breaking Down MODG

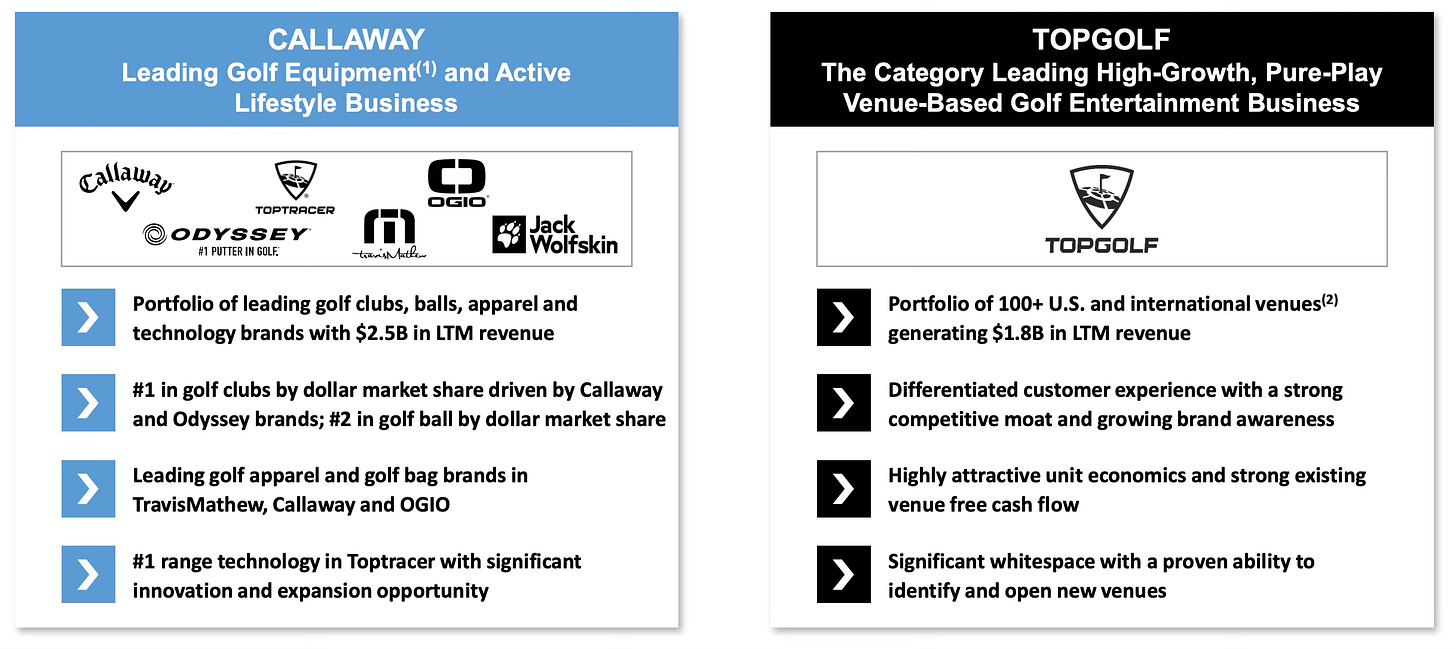

MODG operates across three core segments: Topgolf, Callaway Golf and Active Lifestyle, each with its own unique value proposition.

Topgolf - Where Sports Meets Social Fun and Big Numbers

Picture this: Topgolf is like the bowling alley of golf, but with a twist… players of any skill level can hit microchipped golf balls at giant targets while enjoying drinks and food. It’s a fun, social experience that doesn’t require you to know anything about golf. Now, here’s the kicker: Topgolf generated $1.8 billion in revenue in 2024, with plans to grow from over 100 locations to 250 globally. The unit economics are strong too, with new venues delivering 40-50% cash-on-cash returns and a payback period of just 2.3 years.

Callaway Golf - A Stable Performer

Callaway’s core business in premium golf equipment provides stable, consistent revenue. As the #1 brand in golf clubs and the #2 brand in golf balls, Callaway holds a commanding market share. This division generates over $1.3 billion annually, supported by sustained interest in golf as both a sport and a leisure activity.

Active Lifestyle - A Mixed Bag

This segment includes two brands—TravisMathew, a rapidly growing apparel line acquired in 2017 and Jack Wolfskin, a German outdoor brand that has struggled since its acquisition in 2019. TravisMathew is expected to exceed $400 million in sales by 2024, while Jack Wolfskin has yet to meet growth expectations, though recent leadership changes aim to revitalise the brand.

The Spin-Off Opportunity

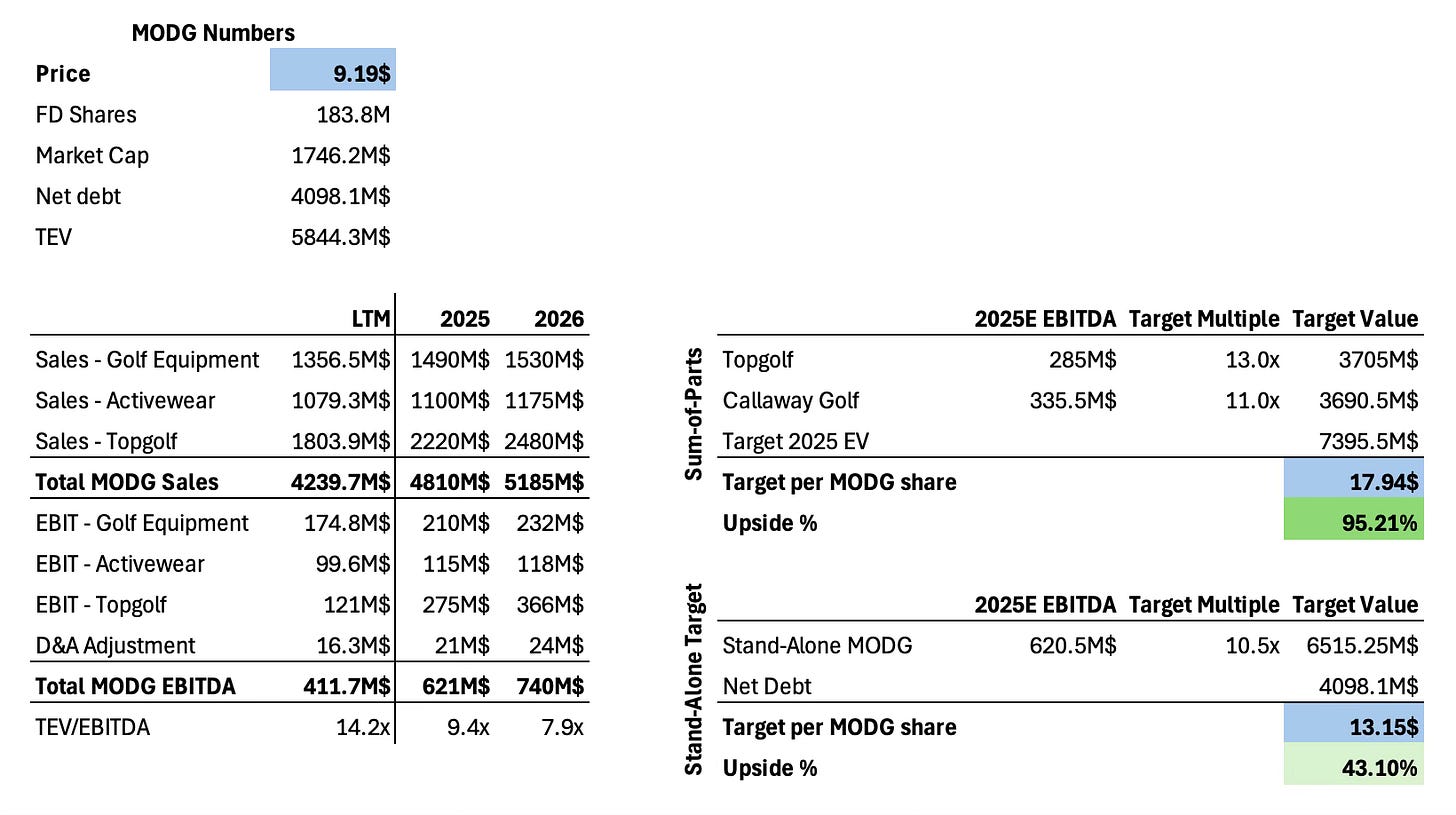

MODG’s potential lies in unlocking the individual value of its businesses. At less than 9.41x projected 2025 EBITDA, MODG’s segments could fetch higher valuations as independent entities.

A sum-of-the-parts analysis estimates MODG’s value at 17.94$ per share, representing an 95% upside. Even without a breakup or sale, the company’s stock could rise to 13.15$ (a 43% increase) as market conditions improve and the company moves past its recent challenges. In a harsh recession scenario, the stock is unlikely to fall further due to its already low valuation.

Financial Overview and Sum-of-Parts Valuation

Topgolf’s unit economics are impressive. With around 100 domestic venues and plans to open 11 more per year, the long-term goal is 250 locations. The financial structure is attractive, with an average $30 million venue build (primarily landlord-financed) generating 40-50% cash-on-cash returns within 2.3 years. Venue EBITDA margins mature at 35%. Globally, there is potential for an additional 250 franchised locations. Based on these metrics, a standalone Topgolf could attract private equity buyers and is significantly undervalued as part of MODG.

Callaway Golf and its Active Lifestyle division also offer strong prospects. TravisMathew’s sales have grown from $60 million in 2017 to over $400 million in 2024, with a goal of reaching $1 billion. Callaway’s golf equipment business competes directly with Acushnet’s Titleist, a high-end competitor trading at 13x EBITDA. Based on a more conservative valuation of 11x EBITDA, Callaway’s equipment and apparel segments could see substantial upside.

Catalysts

MODG is ripe for activist investors or strategic buyers to step in. Topgolf’s global expansion and cash flow generation make it an attractive target for private equity, while Callaway’s steady performance positions it well for a re-rating as a pure-play consumer business. The potential spin-off of Topgolf, combined with improvements in the Active Lifestyle segment and stronger market conditions, could unlock significant shareholder value.

MODG’s recent performance issues, such as poor same-venue sales (SVS) at TopGolf and weak growth at Jack Wolfskin, have overshadowed its underlying strengths. However, the company is beginning to turn the corner, with improving trends and better financial performance expected in the coming quarters. This, combined with the potential for strategic actions like a spin-off or sale, positions MODG as a compelling special situation for investors seeking undervalued opportunities.

To you the verdict... I'm going to wait for the next few weeks and I'm sure I'll come back to this situation in a few months (as it will take at least more than a year to see a possible spin-off).

See you on the next research!

Attilio

If you made it to the end I can only thank you! I hope you have found this article useful and enjoyed it, I will try to be as consistent as possible with the publication and when there are updates I will write another article.

If you would like to support me in this work I would be very glad to receive a like and if you would like to share the post you would give me an incredible contribution to make Strategic Alpha known to as many people as possible!

Before making any investment decisions, it's essential to carefully evaluate all available information and consult with a financial advisor. The analysis presented above is based on publicly available data and reflects potential outcomes under current market conditions, which are subject to change. Please review the full disclaimer below for important information regarding the risks and limitations associated with the content provided.